|

|

|

|---|

Saturday, November 29, 2008

We were dismayed to learn that our comments section had only been available to users with registered Google accounts. That has been changed, so everyone is now free to comment as they see fit.

Apologies.

Labels: blogging

Friday, November 28, 2008

There is still hope for all of you unemployed American LSE grads out there. The Obama administration is swelling with LSE alum.

You can apply here.

Labels: London School of Economics, Obama

Does the health of macroeconomy have an impact on fashion? That's a question I've been wondering about recently. I don't know anything about fashion, but intuitively it seems that there must be some sort of connection between what sort of clothes people wear and the overall health of their economic situation. I mean, wealthy people tend to dress "better" than poorer people - that is to say, their clothing is more aesthetically appealing, judged by the standards of the day. Can we extend that trend to the whole economy and compare between eras?

Well that's exactly what I'm going to try to do here. My idea is that people tend to be more stylish during periods of economic boom. It's not an airtight theory, but it's Friday so bear with me. I realize there's a problem from the outset. I'm subjectively biased towards fashion in that I'm more likely to favour current fashion trends over older ones - it's what I'm used to wearing and seeing around me. But I think, even with that in mind, it's not too difficult to look back at history and say: yes, those people looked sharp, or, oh God! something was horribly, horribly wrong. Also, I'm sticking to North-Atlantic economies because I know less-than-nothing about fashion in the rest of the world. So let's start with post-WW1

1920s

The Roaring Twenties - a few minor recessions notwithstanding, economic growth in the twenties was impressive. It was the Jazz age, there was the jitterbug, and of course there was the infamous stock market bubble. Everyone owned stocks. From Wall St. barons down to their limo drivers, stock tips were being shared and discussed in everyday conversation. Everyone was getting rich.

What do we see? For the women: some funny-looking stockings & bathing caps, this is not bad, nor this. A little, er, old fashioned but classy nevertheless. Same goes for the men: the three piece with hat & hankerchief. And of course Al Capone: badass.

1930s

The Great Depression. Clearly some people managed to stay largely unaffected by the extended economic downturn, but with unemployment at 20%+, things tended to be a little more sober. Or worse. Enough said.

1950s - 1960s

Post-war recovery was remarkably rapid, even in Europe. Economic growth, particularly in the 1960s under Kennedy and Johnson, was averaging around 5-6% per year - that's unbelievable by today's standards. This was the era of cheap oil & boat-sized sedans, big industry and safe union jobs. As Patrick at zzzeitgeist pointed out, it was a period of unrestrained consumption.

And man, they looked sharp. The fedora continued to reign supreme. No complaints about the introduction of the mini-skirt, either. Or maybe I've just been watching too much Mad Men.

Of course, I'm forgetting the hippies. But the hippy movement didn't really take off until the late 60s and early 1970s - and by 1968 the economic policies of the previous decade had begun to hit the wall....

1970s

Let's take the period from January 1970 until the end of 1982: that's thirteen years or 156 months. According to economist Timothy Taylor, the US economy spent 49 of those months in recession (re: negative growth). That's almost a third of a decade n' change spent in recession. Yikes.

As for the fashion, well - there are no words. Like monks flagellating themselves to atone for their sins, people in the 1970s attempted to make up for their previous economic excesses by forcing themselves to wear horrible, horrible things and listening to disco music. I can't even begin to... what were they... the fat tie... David Bowie!? Make it stop. Please, make it stop.

1980s - early 1990s

The 1980s were sort of a hangover from the 1970s. There were a couple of recessions and government debts rose rapidly. Conservative politicians in the US, UK and Canada implemented neoliberal economic policies, which led to economic pain and social displacement in many areas of the economy.

As my theory predicts, the 80s is known for some pretty questionable fashion taste. We've got the Big Hair, exhibit A, B and OMG. Of course the MC Hammer parachute pants and the hip hop square-cut. I could go on.

But, you want to counter, the 80s was awesome and so was the music!1! Well, you're wrong.

Mid-1990s to present?

Since the rapid economic growth of the mid- to late-1990s, it's my general impression that people have started to dress better again. We've left some of the crazy experiments of the last two and a half decades behind. Granted, the suit & fedora-wearing gentleman has all but disappeared, but I'm noticing that at least pinstripes are making a comeback.

I recognize that this is a huge generalization, and that clearly different groups within society have different tastes. Moreover, this is not to say that we don't have some laughable fashion items of our own these days. My housemate has nominated board shorts with floral patterns. My personal choice is Ugg boots - you want to know who was wearing those boots 20 years ago? That hideous woman from the Shining, that's who. Feel free to add your own in the comments section.

Conclusion

This is, admittedly, not a particularly robust thesis. Nevertheless, I think the idea that fashion reflects the economic zeitgeist is a plausible explanation for the ups and downs in fashion history over the past century or so. As we enter into what many people are labeling "the worst economic crisis since the Great Depression," this is something worth pondering. During the 1930s, President Roosevelt proclaimed that there was nothing to fear but fear itself. But back then, Roosevelt was not yet aware of an even scarier possibility: the return of polyester.

Labels: Dave's crank theories, economia, FASHION, HISTORY

Wednesday, November 26, 2008

What's the deal... with fiscal stimulus? That's the burning question that's on everyone's mind these days - yes, everyone. At least it should be, since most members of the G20 have committed to using some sort of fiscal policy measures to compensate for the increasingly futile efforts of central banks to stimulate the economy. Although most people don't care to know the details of this debate, it matters a great deal: somewhere down the line, you're going to get upset with the government for either a) raising your taxes to pay for wasteful spending commitments or b) raising your taxes/cutting benefits to pay for government deficits induced from earlier tax cuts.

Rather than compare the benefits of tax cuts vs. govt spending on "bang for buck" (govt spending will win because it adds more to GDP), the quoted article suggests that the two approaches should instead be assessed on 1) the value of increased spending (adv: tax cuts), and 2) the precision of timing (adv: govt spending).

The common argument is that "Unlike the consumer, the government does not reliably spend extra resources on valuable purchases." Examples are not hard to find (cough, Detroit), and politicians are notorious for building roads, bridges and roundabouts to nowhere. In short, there is more overall value in the aggregate decisions of market actors - this is why centrally planned economies fail miserably.

Second, although it's true that governments tend to be more wasteful than consumers, Thoma questions whether market actors are really directing their resources towards things of higher value: "Like purchasing stocks and houses in a bubble, things like that?" Equally, we find roads to nowhere built by the private sector: they lead to abandoned housing construction projects.

The big advantage for fiscal stimulus is that it can concentrate spending on large projects that will last well beyond the economic troubles - projects that may not otherwise have been implemented by the private sector due to market failure, lack of economies of scale, or

what-have-you. The counter-argument is that, unlike the make-work projects of the New Deal era, building infrastructure requires much more specialization these days. You can't just hire a bunch of people with shovels. That means the spending will have a long lag-effect before it kicks in - perhaps too late.

what-have-you. The counter-argument is that, unlike the make-work projects of the New Deal era, building infrastructure requires much more specialization these days. You can't just hire a bunch of people with shovels. That means the spending will have a long lag-effect before it kicks in - perhaps too late.It seems that for every good argument on one side, there is an equally good counter-argument on the other side. Tax cutters say that fiscal stimulus is just wasted through "leakage" and that it is difficult to turn off the money tap once it's opened. Fiscal spenders counter that tax cuts are also extremely difficult to reverse and that consumers may choose to spend money on goods made outside the country - a form of leakage on its own. So what to make of all this?

It seems that the best solution is to find creative ways to bring elements of both sides together, perhaps taking advantage of the benefits of both. One idea is to reduce value-added taxes on consumer products, but place an expiry date on the reduction to encourage spending now. Another, which Thoma suggests, is merely to break up a stimulus package into pieces, some of which involves targeted tax cuts and others which focus on projects with high social value.

Sounds good to me.

(First image: lmno4p.org; Second: markybaby.com)

Labels: economia, fiscal stimulus

Monday, November 24, 2008

A lazy post for a lazy Monday, but hopefully you'll find it interesting. It's a short clip from Our Daily Bread, a feature-length documentary produced by Nikolaus Geyrhalter.

Having never wondered how pecans and walnuts are harvested on an industrial scale and then seeing how it's actually done for the first time, we were quite taken aback. It was as if discovering a new species of marine animal thriving in the violent hydrothermal whirlpools of some deep-oceanic trench — spectacularly ornamented, wondrously strange, marvelous.

Our reaction obviously says more about how far removed we are from the means of food production than anything about an inherent quality, but agricultural landscapes never fail to astonish us.

On agro

Labels: agriculture, trees, videos

In August we pointed out that summertime worries over inflation were probably overstated. Since then, a collapse in commodity markets and consumer spending has vindicated this view - so much so that the new worry is deflation. Deflation is by most accounts worse than inflation because of the difficulty in reversing the trend. First, a backgrounder:

Deflation is "A general decline in prices, often caused by a reduction in the supply of money or credit.... Declining prices, if they persist, generally create a vicious spiral of negatives such as falling profits, closing factories, shrinking employment and incomes, and increasing defaults on loans by companies and individuals. To counter deflation, [central banks] can use monetary policy to increase the money supply and deliberately induce rising prices, causing inflation."

The trouble is, central banks have been attempting to increase the money supply by lowering interest rates with less-than-stellar success. Besides, there are inherent limits to monetary policy - limits which seem to be approaching quickly.

So what to do? John Kemp argues forcefully that the best way to deal with deflation is to stop trying to fix it. Que? Based on his reading of previous depressions, deflation is the symptom of a severe decline in the business cycle, not the cause. The full article is very interesting (so is this one), but the conclusion reads as follows:

Rather than worrying about a modest decline in the price level, policy needs to focus on guaranteeing households and businesses against the worst aspects of the downturn to minimize the decline in spending and investment. Policies that create demand and jobs, while limiting foreclosures and bankruptcies, rather than fight the deflation chimera or worry about falling asset values are now the urgent priority.

That means fiscal stimulus! But rather than rely upon the government for everything, Dr. Boli recommends that consumers also do their part (via Megan McArdle):

Labels: economia, fiscal stimulus, humour, Inflation, Monetary Policy

Saturday, November 22, 2008

While IPE Journal got a makeover...

Politique

-The US National Intelligence Council's 2025 project releases Global Trends 2025: A Transformed World. The report announces the end of the "unipolar moment", and predicts declining American influence and power. While the US will remain the preeminent power, the rise of the BRICs will reintroduce a multipolar world. Other defining trends: increasing competition for scarce resources, greater West-East transfer of wealth, and broader Middle East destabilization.

-World trade is grappling with a tricky little pirate problem, as Saudi joins a NATO anti-piracy fleet and calls for a global response to this "terrorism".

-The IAEA confirms speculation that the Syrian structure bombed by Israel in 2007 contained nuclear material. Syria swiftly calls for end to probe.

-Obama announces plans to create 2.5 million jobs through massive fiscal stimulus, government projects. His cabinet takes shape: Geithner for Treasury, Clinton at State (the Guardian broke her acceptance plans, beating US media to story), and reported negotiations for Gates to remain at Defense.

Economia

-Citi executives huddle in New York with government officials to discuss the bank's survival. The Dow Jones Industrial average closed below 8,000 this week, the first time since March 2003.

-Japan falls into recession, ending longest postwar expansion.

-Pakistan formally requests $7.6bn IMF standby loan, agrees to economic reforms including fiscal deficit reduction.

The Rest

-Scientists now believe that massive glaciers may lie beneath the rocky Martian surface, and humanity is step closer to confirming life beyond Earth.

-Arsenal drop Gallas, ManU lose Berbatov for big Villa clash, and Liverpool/Chelsea stay top of Prem

-Vanity Fair releases its International Best Dressed List. This year's list includes Michelle Obama, Kate Middleton, and Kanye West. West drops a full preview of new album, 808s and Heartbreak.

Find out here...

Labels: commodities, energy, Europe, Russia

Friday, November 21, 2008

Since its Friday, some light fare to take your mind off the fall of Rome:

-Arsene Wenger, obviously having read IPE Journal last night, has reportedly stripped William Gallas of his captaincy. Furthermore, Gallas will not travel with the club to Manchester City this weekend. There is intense speculation over who will take up the arm band, with Gael Clichy, Kolo Toure and Manuel Almunia the frontrunners. Some believe that when Cesc Fabregas returns from suspension next week, he could assume the captaincy for the remainder of the season.

This is an extremely positive (and necessary) move by Wenger, and will hopefully provide the jolt Arsenal needs to make a strong second-half/European run. My vote goes to Fab, the club's talisman and future.

The current Bond series, much like Batman, is an interesting reflection of our times. The 1990's (ahhh the 90s) gave us Pierce Brosnan, a solid Bond character, but kind of fluffy and flashy. Sean Connery had the charm and slick image, but there was a gritty ruthlessness to Connery's Bond that lay just under the cool exterior. Brosnan lacked this. Some Bond purists believe that Craig's version is too rough. I disagree, and believe that Craig is more in the tradition of Connery than Brosnan ever was. Importantly, the new Bond films substitute flash for substance. It forces you to question the actions and intentions of 007. He may be working towards an ultimate good, but has he corrupted himself along the way?

We in the West live in a darker, more confusing time. In our heroes we find both hope and despair. Bond is a perfect reflection of this shift.

Arnold Kling presents a brief history of state-finance relations. Whereas modern economics assumes a market economy and explains the use of money as a tool to make it work better, Kling argues that, in his "skewed view" of financial institutions, the use of money developed well before the market:

According to the skewed view, there was never a state of nature in which financial institutions roamed free in the wild, to be later tamed by regulators. Instead, financial institutions were fundamentally institutions of government. Entrepreneurial finance is a modern development, and its separation from government may always be tentative.

Skewed? I thought that this was mainstream. The emergence of "the market" as a distinct entity is extremely recent in terms of human history. If you had asked a peasant in 16th century about the market, he/she would have pointed you towards the stalls selling produce in the town square. The whole concept of shifting power from the state to market forces would have been nonsensical.

This is why, prior to Adam Smith and his contemporaries, economics (or political economy, as it was then known) did not exist as a field of study. How could it? Every aspect of what we would now label economic activity was deeply intertwined with social, political and power relationships.

Of course, it still is. Marx and his followers represent one version of this story, but there are many variations to choose from. Oxford and Cambridge still offer courses in PPE (Politics, Philosophy and Economics) because they recognize the necessary overlap. This makes the attempt by modern academia to separate political studies from their economic counterparts all the more frustrating.

Not only are the Wall St./Main St. dichotomies annoying, they're misleading. If anything, the recent financial turmoil has reminded everyone of the importance of treating "the state" and "the market" as complementary, not adversarial, components of our social structure. And in case there was any doubt: Rory and I started the IPE Journal to explore this relationship and try to make some sense out of it all.

How are we doing so far?

Labels: banks, credit crunch, humour

Thursday, November 20, 2008

Despite my futile job search, a global financial crisis, and the lingering feeling that maybe the whole "grad school in London" adventure was poorly timed, I have a much bigger worry on my mind: Arsenal.

Despite my futile job search, a global financial crisis, and the lingering feeling that maybe the whole "grad school in London" adventure was poorly timed, I have a much bigger worry on my mind: Arsenal.

The Economist has a fanciful, tongue-in-cheek editorial on the possibility of solving some of the world's troubling dilemmas by purchasing bits of other countries. Spurned on by the recent proposal by the Maldivian president to buy a new homeland for his drowning nation - rising sea levels threaten the tiny island nation with extinction - the Economist suggests using this approach elsewhere:

The Israelis, for instance, could put an end to a hundred years of futile hostilities by buying somewhere for the Palestinians. If they clubbed together, they could get somewhere really nice—Florida, maybe. China could stop making aggressive gestures towards Taiwan and buy Malaysia instead. It’s already run by

Chinese, so they’d hardly notice the difference.

When I was a teenager, I naively toyed with the idea of a land-swap to address some sticky international issues (the citizens of N. Ireland might actually enjoy the weather along the West Bank, after all), but the market solution seems a better approach.

Labels: international affairs, The Invisible Hand

Wednesday, November 19, 2008

Here's an educational video from Japan's Ministry of Agriculture, Forestry and Fisheries. It's remarkable for making very complex, interconnected issues — i.e., food security, public health, global trade, energy and geography — more readily understandable. And in under 5 minutes! Quite an amazing feat.

It's rather reminiscent of the ephemeral films made by government agencies and corporations of 1950s America. The production quality here is more slick, but it's still propaganda, a brand of social engineering instilling institutional definitions of patriotism and good citizenship. Good Japanese eat Japanese food.

Cultural hegemony via pastel colors and infographics porn.

There should be more of these made everywhere.

On agro

Reveal Me

Labels: agriculture, data_visualization, videos

Technology had a significant impact on the 2008 US presidential election. The Obama camp leveraged the technological innovation of Howard Dean's 2004 primary campaign to expand voter and donor outreach to an historic scale.

Despite the enormous impact of this application, a single piece of technology revolutionized the way American's receive, analyze, and interpret political information more than any other. The internet, you say? wrong. Surely the Blackberry, then? nope.

CNN's magic wall.

Ah, the beauty of exploring Ohio congressional districts. The fun of touch-screen graphics. The elegance of John King, the maestro, spanning time and space to deliver trivial and imprecise insights into voter trends. To many, the magic wall was the enduring image of this campaign, without which, democracy would surely have crumbled.

But is the magic wall really so benign? Is John King the Bernstein of touch-screen technology, or something far more sinister? The Daily Show's John Oliver finds out:

Labels: Politique

Tuesday, November 18, 2008

The recipient of the 5th Rosa Barba European Landscape Award, announced recently in Barcelona during the 5th European Biennale of Landscape Architecture, is the Nicolai Kulturcenter in Kolding, Denmark, designed by Kristine Jensen.

The project, we read, involved transforming what was little more than an alleyway — or a “lousy backyard,” as the landscape architect describes it in the most recent dispatch of Terragrams — into a multipurpose cultural space that is “more attractive and inviting than its predecessor.”

The program “consists of various elements that are connected to areas designated for outdoor activities: the entrance; a garden where children can play and relax on the grass; a terrace for patrons of the cinema cafés; a large circular stage used for outdoor cinema in summer and for theater performances and concerts; a shopping area; a small garden next to the music hall; and a multifunctional square. A Cor-Ten steel wall and a Cor-Ten steel stage/platform have been built along the two terraces situated on the west side.”

Apart from the stage, perhaps the site's other signature element is the graphic pattern, rendered on the ground out of white thermoplastic. It gives the space an element of play and fun, which is a nice contrast to the industrial nature of the Cor-Ten steel, the grimy asphalt and the dour facade of the buildings. Moreover, it helps to partition the various outdoor rooms without adding to the clutter. There is compartmentalized density but also an openness and a flexibility, order but also disorder.

In her presentation of the project at the biennale, Jensen quoted Marc-Antoine Laugier:

Anyone who knows how to design a park properly will have no difficulty designing a plan by which a city will be built - in terms of its location or area. Squares, intersections and streets are needed. Regularity as well as strangeness are needed, correspondences and antitheses, accidents that vary the picture, great order to the details, but confusion, clashing and tumult in the whole.

“This quotation,” explained Jensen, “not only reflects the necessity of contradiction and counteraction in any kind of planning, whether the character is evergreen or never green, to me it also reveals a simple program on how to work within an urban context.

“Parks, as well as cities, are built, dismantled and rebuilt over time - revealing structures and spaces that reflects the ongoing times in the urban fabric that dissolve into a different sort of text or narrative patterns that engender superficial depths. In this, at both daylight and neon light, the world unfolds itself in a super spatial surface as complex, immeasurably vast, wonderful and sometimes almost incomprehensible.”

Willem Buiter - LSE prof and former Bank of England Monetary Policy Committee member - explains why he writes his blog for the FT:

There are minor vanity/ego rents to having people read what I write, and my consulting income may receive an indeterminate boost from these activities. But all that is secondary to my need to write. I don’t know something unless I have written it down.I agree completely. Too bad I can't guarantee the opposite relationship: just because I've written it down...

Labels: blogging

Monday, November 17, 2008

I don't read Thomas Friedman that often. I always found his "flat-world" theory to be lacking an appreciation for the asymmetries in the international political economy. I think a world of "peaks and valleys" is a more appropriate image. But who am I? Friedman's sold a billion books, won multiple Pulitzers, and is rumored to garner circa $50,000 per speaking engagement. Obviously, he's doing something right.

But I do read Dave Hart (regularly in fact), whose great piece on the Big-3 got me traversing the internets for opinion on the prospects of an automotive bailout. This led me to Friedman, whose recent media crusade against the US auto industry I find spot on. His 11/11/08 NYT column, "How to Fix a Flat", sums up his criticism of the US Big-3 automakers:

for years, executives, lobbyists, and Congress (in particular the Michigan delegation) have sheltered these companies from the need to innovate or die. The have been allowed to resist higher environmental and fuel-efficiency standards, and implement bone-headed strategies that prioritized the SUV over hybrid or smaller, fuel-efficient vehicles. And now, as their business model, balance sheets, and beloved SUVs are forcing them into bankruptcy, these companies feel entitled to a taxpayer-funded bail-out?

I share Friedman's (admittedly, everyone's) outrage. I recognize the risks to the real-economy of their bankruptcy. Millions of workers (if you include suppliers) would lose their jobs in a period of rapidly rising unemployment and deflation. I also believe that the sensible arguments against Chapter 11 are important: in the current credit environment, Chapter 11 restructuring might be impossible, giving way to Chapter 7 and the worst-case scenario. But what is the chance that these companies will be compelled into any of the necessary restructuring in exchange for further financial assistance? Remember, the US government has been bailing these bozos out for decades, and what have we received in return? Sasquatch.

As Clusterstock pointed out, a short/medium-term cost benefit analysis might fall in favor of a bail-out. But what then? The shield that would be erected around these three posterchilds of protectionism would take decades to dismantle. The union contracts would remain largely in tact (not a chance Dems are jeopardizing the Rust Belt in 2010)*. CAFE standards are already (predictably) being vilified by the auto companies.

The US economy can't afford an industry collapse. But taxpayers can't afford another waisted bailout. If they agree to the thorough concessions and restructuring Friedman and Ingrassia call for, then bail em out. If they don't, let creative destruction work, and follow Friedman's advice. Allow Chapter 11, compel independent administration, and set these companies toward a restructuring process long overdue. One company might go into bankruptcy, but like the investment banks after Lehman, the others will quickly fall in line and accept strict conditions to assistance.

We must also renegotiate the contracts of remaining workers (on fair terms- whatever those are), increase unemployment benefits, and retrain those who are laid off in green jobs or re-employ them in a massive infrastructure-based stimulus project. And how about universal health care reform as well?

We need the political will (finally) to confront the auto industry and dictate the terms of assistance. This means confronting their stubborness head on. It may be risky, but its a risk worth taking.

Labels: credit crunch, financial crisis, nationalism, Politique, protectionism

I woke up this morning to the following headline on the front page of my Financial Times:

"Pandit's Pep Talk: Citigroup boss calls a 'town hall' meeting aimed at restoring morale of 350,000 staff".

Make that 300,000 staff. So much for morale.

Labels: credit crunch, financial crisis, Lords of Finance

Of all the phenomenal spaces concocted by Paisajes Emergentes for their entry in the Parque del Lago ideas competition, our favorite one has to be the open-air theater that doubles as a rainwater storage tank.

Or is it a water tank that occasionally hosts cultural events, the itinerary being dependent on weather conditions beyond a day's forecasted precipitation? One can't imagine it functional during the wet season or even during the dry season if rain isn't particularly scarce.

Of course, there's a simple solution: build a floating stage. The number of available seats might then determine what sort of program can be scheduled. If mostly empty, a popular band can be booked. If one or two tiers are available, an experimental play. How about a local production of Mary Zimmerman's Metamorphoses or an avant-garde staging of The Odyssey? A micro-naumachia?

Even in its flooded state, however, the space is still occupiable, a point of interest just like any of the artificial lakes and pools in the park.

Surprisingly adaptable, it's a space attuned to the temporal vagaries of climate, the fluctuating rate of water consumption and the cultural preferences of Quito's residents.

Rainwater Harvesting in Al-Andalus

Labels: stormwater

Sunday, November 16, 2008

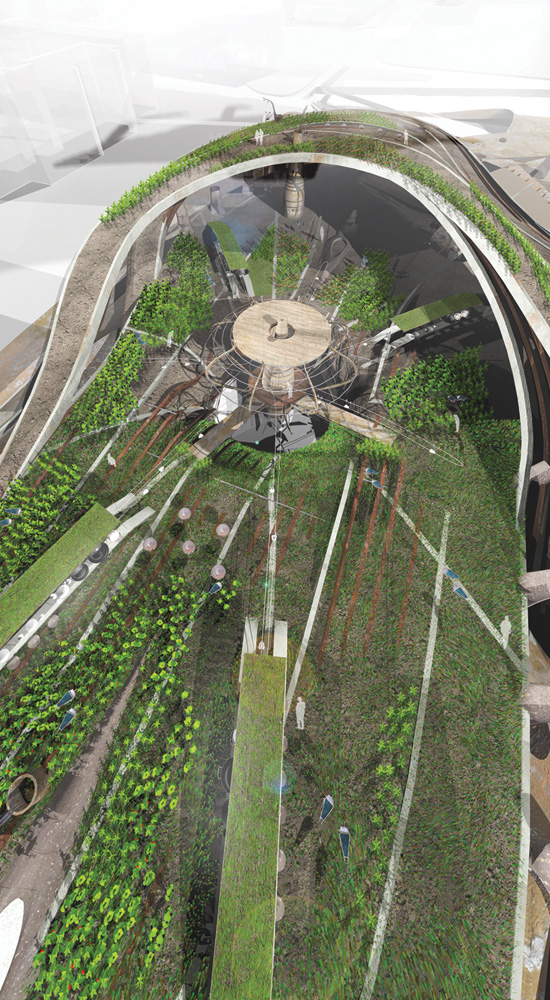

To finish off this series of student projects from Nannette Jackowski and Ricardo de Ostos's vertical studio at the AA is Taebeom Kim's Gastronomic Garden.

There's a lot of things happening here. First, there are the allotment gardens hovering over — perhaps are even propped up by — compost tanks used for recycling garden scraps as well organic waste of local residents.

One particularly large bulbous structure, somewhat reminiscent of sludge digesters at some sewer treatment plants, is designated as a place for contemplation, though it would most likely become a site of illicit activities and even grave criminality in the real world.

Somewhere on the site is a parking garage. This, together with the compost tanks, would generate energy via a process that unfortunately isn't elaborated in the project statement nor in the images we have on hand. We suspect the “oven tower” plays a role. Something to do with (carbon monoxide) convection perhaps?

Connecting its “semi-independent levels” of leisure and production are walkways and bridges for vehicles and pedestrians.

Of the four projects, this is the least site-specific and therefore hardest to determine how well it fits into the city or if its contextual engagement is, per the studio brief, primarily urban. Is it in London or could we even be in the countryside? One has to give it a generous benefit of a doubt to accept that it wasn't arbitrarily plopped into place.

In any case, to our own delight, this vagueness allowed us to easily recast the project as a proposal to adaptively reuse some of the complexly braided highway intersections in the U.S., many of which twist and turn in the middle of the city. By some implausible circumstances, perhaps now made at least imaginable with the financial crisis and, despite the current respite, the still looming post-oil era, patterns of habitation and mobility have rendered them obsolete. Empty of cars, they can now be colonized by eager gardeners who have been on waiting lists for allotments for years. In the middle of each cloverleaf would be waste recycling towers and “meditation” domes. Instead of ribbons of concrete, you have ribbons of vegetables.

Or: let the cars stay. But envelop the elevated roads in sound-dampening tube, as seen in the image above or at OMA's McCormick Tribune Campus Center at IIT. Inside, motorists will be bathed in extraterrestrial neon, deprived of photogenic skylines and waterfront vistas. Outside, you have horticultural Möbius strips and knotted access ramps coiling around this smog-filled airborne tunnel, tight like a noose, then extending out to colonize adjacent negative spaces.

King's Vineyard London

Aquaculture

Farmacy

On agro

Labels: agriculture, student_projects

As most well-informed observers were stressing all week, yesterday's G20 meeting in Washington was not going to lead to new financial architecture for the glo bal economic system. "Bretton Woods, the Sequel," this ain't. For one, it was not taking place in the New Hampshire hotel after which the original conference was named (see photo). For two, this meeting was not complemented by several years of preparatory groundwork or by unilateral American leadership coming on the heels of a paradigm-shifting depression and world war. So maybe Mr. Brown and Mr. Sarkozy were getting ahead of themselves with all of their blustery rhetoric.

bal economic system. "Bretton Woods, the Sequel," this ain't. For one, it was not taking place in the New Hampshire hotel after which the original conference was named (see photo). For two, this meeting was not complemented by several years of preparatory groundwork or by unilateral American leadership coming on the heels of a paradigm-shifting depression and world war. So maybe Mr. Brown and Mr. Sarkozy were getting ahead of themselves with all of their blustery rhetoric.

Now, as is expected for these types of events, the G20 meeting produced a declaration (available here) that contained a fair bit of vague language on what the world leaders are going to do to a) address the current crisis and b) fortify the financial architecture to prevent a repeat performance. But the meeting did produce one, large, significant shift in the way our global economy will be governed in the near future: the G20 appears to have taken over from the outdated G7/G8. On this point, the punditry appears to be unanimous. This is important because the G20 includes powerful emerging economies like Brazil, China, India, Indonesia and Turkey.

This shift is long overdue, but will necessarily make international negotiations that much more difficult. As I alluded to above, the successful completion of the original B.Woods in 1944 was in large part due to the ability of the United States to push its agenda forward unilaterally. Had the Brits not been so crippled by the war, they surely would not have ratified the agreement. It should be clear that, 60 years on, there remain important philosophical differences between the Americans and Europeans on financial governance. Insert China and India into the mix and things become more complicated. But global financial governance is complicated and excluding these countries is a non-starter.

The agenda for the G20 membership from now until the next meeting in April 2009 is to make progress on a number of fronts. Highlights:

- Reform of the World Bank and International Monetary Fund to be more representative of the distribution of economic power (not new).

- Expand the membership of the Financial Stability Forum to include G20 members (relatively new). The FSF is a body that combines governments and international regulatory agencies to establish "best practices" in everything from accounting to insurance.

- Members have agreed to undergo a financial checkup by the IMF and increase funding for IMF lending programs to crisis-stricken countries (that's right, the IMF is relevant again).

- Various other sensible, but hardly revolutionary, promises to beef up financial supervision.

- And finally, a promise to deal with the fact that the Doha round of trade negotiations is dead. It has ceased to be. Bereft of life, it rests in peace. It's bleeding demised. It has rung down the curtain and joined the choir invisible...

Labels: Financial Architecture, G20, IMF

Saturday, November 15, 2008

In August this year, a design competition was launched to generate ideas to repurpose Quito's Mariscal Sucre International Airport after its planned closing in a couple of years.

According to the organizers, “the coming availability of 126 hectares of space with a flat topography, located in the midst of a consolidated area, which thanks to the decision of the Quito Metropolitan Council, will be transformed into a park, constitutes an exceptional event and a unique opportunity. This leads us to rethink the city and to take advantage of the opportunity to set forth solutions to multiple issues linked to: changes in the use and building capacity of land; improvement in mobility and transversal connectivity; expansion of infrastructure; provision of green areas and public spaces; improvement in environmental conditions, recovery of urban landscapes and environment; improvement of the quality of life of present and future inhabitants of the city.”

We only learned of this competition, because two teams that had submitted entries uploaded their images onto their Flickr accounts after the results were announced late last month. Both projects are quite spectacular, visually gorgeous and brimming with ideas. We'll post them separately, and should we find more entries and like what we see, we'll publish them here as well.

The first team, then, is Paisajes Emergentes, a studio collective based in Medellin and Bogota, Colombia. Its members include Luis Callejas, Edgar Mazo and Sebastian Mejia.

This is their Second Prize-winning entry, in all its linear awesomeness.

Per the competition brief, water has to be central element in the design. After all, the organizers refer to the future park as Parque del Lago.

In response, Paisajes Emergentes flooded the 3-kilometer runway to create an “active hydrologic park,” which they then partitioned into 6 programmatically discrete areas.

1. At the north end of the park are wetlands. These bioremediate water redirected from the other end of the park after having run its course through this outrageously elongated pool.

2. Relatively clean water from the wetlands is then used to fill an open air aquarium. The tanks here contain fluvial species from tropical ecosystems.

3. An aquatic botanical garden comes next in this hydrological assembly line. Whereas the faunal variety is showcased in the aquarium, tropical plants are the main attractions here, though both are equally essential to maintain any kind of a robust ecosystem.

4. From there, water moves into circular water tanks, where it is mechanically oxygenated and filtrated. Pedestrian walkways involve people with an infrastructure and a process that are usually hidden from them. Meanwhile, one has to question the placement of these tanks. Shouldn't it be at the head of the line to take care of the heavy duty stuff? Given the park's closed system and the proven ability of constructed wetlands to improve water quality biologically, is a “conventional” treatment plant, of that scale, even necessary?

5. In any case, the water must meet legal standards of quality if they are to fill the public pools and thermal baths. A combination of wind and solar energy is used to heat this aquatic complex.

6. Finally, we come to a recreational lake, where the water is collected in subterranean tanks to satisfy the need of irrigation systems and general maintenance of the park before.

Additional activities are also programmed adjacent to this central pool. For instance, the old terminal building is turned into a convention center. Soft materials and walls are removed, and the remaining forest of columns confine 3 theaters inside hanging gardens.

There is also an open air aviation museum, where a fleet of planes are allowed to rot in their obsolescence. A wetland fed by waters from the botanical garden is allowed colonize this area. In time, the planes become a sort of Picturesque ruins of the industrial age, sinking into deep mire, crumbling in the wilds.

Meanwhile, it would have been nice to see how the park relates to its context, apart from suggesting amenities the local community may (or may not) need. Graphically, the site looks divorced from the urban grid. All paths radiate out of the terminal building and one parking lot on the other half, then terminate just before they reach the edge of the park. Opportunities for more meaningful connectivity between the surrounding neighborhoods and between the north and south parts of the city seem to have been missed.

For more images, visit the Flickr account of Paisajes Emergentes.

Dispatches from a Post-Water Chicago

Treating Cancer with Landscape Architecture

Treating Acid Mine Drainage in Vintondale

Quito 2: Back to the Airport

Labels: adaptive_reuse, competitions, wetlands

Politique

-G20 leaders arrived in Washington for a summit that had been hailed Bretton Woods II. With President-elect Obama avoiding the summit, and sharp differences between world leaders on the reforms needed to repair the international financial and economic systems, the summit ends like so many before it- with a consensus on principles, little coordinated action, and an agreement to meet again. Declaration text here.

-A regional war looms as the situation in the DRC deteriorates. African peacekeepers are impotent and declared targets by Nkunda, the number of foreign troops/mercenaries in the country grows by the day, and southern African leaders are threatening full-scale military involvement. The NYT looks at the role of minerals in the DRC's history of conflict.

-The EU agreed to restart talks on a strategic partnership agreement with Russia following an EU/Russian summit at Nice. Russia hasn't met the EU conditions set out as a prerequisite to talks following the conflict in Georgia, and it seems only Lithuania has the spine to say so.

-Iraq's cabinet approves new security pact with the US. The agreement extends US troop mandate through 2011.

Economia

-Paulson shocks congress with plan to spend remaining TARP money on capital injections into troubled institutions and companies and consumer spending. The Treasury will no longer purchase illiquid assets, and congressmen/women of both parties are screaming "bait and switch". Paulson deputy Kashkari testified before an angry House, with Rep. Elijah Cummings asking him, "Is Kashkari a Chump?"

-Treasury v. FDIC. FDIC's Bair wants to directly assist 1.5 million homeowners in the US, while Paulson resists a (*cough-cough*) "government spending program"- Paulson believes that his actions are "investments".

-Is a sterling run imminent? That's what George Osborne, Tory shadow chancellor, implied this week in criticizing Gordon Brown's fiscal plans. Osborne's political career is likely done. Sterling has hit a 6-year low against the dollar at $1.49, and Simon Derrick at BoNY Mellon believes sterling's position is now worse than Sept. 1992.

-Eurozone enters its first official recession.

The Rest

-India celebrates first lunar landing.

-This week in Japanese innovation: a robot that feeds you, and bionic legs.

-Arsenal's Prem title run is dead in the water.

-Gordon Brown: control freak.

Labels: Arsenal, Currencies, economic reform, Europe, finance, financial crisis, Football, Georgia, India, Japan, Russia, sport, The Bottom Billion, TWTWTW

Thursday, November 13, 2008

The shares of General Motors, America's largest automaker, are now worth less than those of Goodyear. In a sense, GM is now worth less than the sum of its part. This is bad news, not only for those employed by GM, but for everyone who is even remotely concerned about the government throwing caution to the wind and bailing out uncompetitive, politically-sensitive industries.

Unlike the airline edition of this series, I have nothing personally riding on the outcome of this bailout debate. Nevertheless, the principle is the same. If a firm with as many assets as an enormous automotive company cannot receive financing, there's got to be a good reason. In fact, there are two good reasons. The first is that, due to the credit crunch, financial institutions are currently de-leveraging their liabilities and are thus unwilling to take on a large-scale financing project of this nature.

The second, more relevant, reason is that these firms have been operating under a failing business strategy for at least a decade. These companies are simply uncompetitive: they have over-priced, lower-quality vehicles (pickups excepted), silly-expensive labour union deals and are failing to adjust to environmental concerns.

Moreover, this bailout plan smacks of thinly-disguised politicking. It is a well established fact that the Big Three have considerable traction in Washington, and a Democrat-dominated legislature tends to lean towards protectionism on these issues. In any event, we'll find out on Monday how this one is going to play out. In the meantime, some questions to ponder and some readables to read.

Question first: Do the Big Three pose systemic risk for the economy in the same way that Bear Stearns or AIG do? If not, why are they being considered under TARP?

Links

- FT Alphaville thinks we've moved past moral hazard into a barely-concealed sense of entitlement. Nobody "deserves" a bailout.

- GM wants a bailout? Clusterstock lays out their conditions.

- Clusterstock responds with a counter to its own argument.

Labels: creative destruction, credit crunch, moral hazard, readables

The Times of London has published the leaked details of a conversation between French President Nicolas Sarkozy and Russian Prime Minister Vladimir Putin in Moscow on August 12th. Sarkozy had flown to Moscow to broker a ceasefire between Russia and Georgia, and Putin made his ultimate goal clear. The following is an excerpt from the Times article:

The Times of London has published the leaked details of a conversation between French President Nicolas Sarkozy and Russian Prime Minister Vladimir Putin in Moscow on August 12th. Sarkozy had flown to Moscow to broker a ceasefire between Russia and Georgia, and Putin made his ultimate goal clear. The following is an excerpt from the Times article:

Mr Sarkozy was aware from intelligence reports that the Russian army was aiming to overthrow Mr Saakashvili and install a puppet government. He told Mr Putin that the world would not accept this, according to Mr Levitte, Mr Sarkozy's foreign policy chief, who was in the Kremlin for the talks.

"I am going to hang Saakashvili by the balls," Mr Putin replied.

Mr Sarkozy responded: "Hang him?"

"Why not? The Americans hanged Saddam Hussein," said Mr Putin.

Mr Sarkozy replied, using the familiar "tu": "Yes but do you want to end up like (President) Bush?" Mr Putin was briefly lost for words, then replied: "Ah, you have scored a point there."

Wow. It is rare that the private conversations of heads of state are leaked to the public, and really suprising that the French would do so just days before Sarkozy chairs an EU-Russian summit in Nice (ironically, the scene of one of France's biggest diplomatic blunders of the past decade- see EC Nice Summit of 2000). There is little utility in angering/embarassing the Russians ahead of a vital strategic meeting, and the leak can probably be chalked up to Sarko's super ego.

Wednesday, November 12, 2008

A number of important developments in the global energy markets over the past few weeks:

-an IEA report finds that the world's oil output is declining at a rapid pace. The annual rate of decline is projected at 9.1% without a substantial increase in upstream investment. Even after recent investment, output from the world's largest oil fields is falling by over 6%. As my analysis of Russian energy production highlighted, an increase in upstream investment is neither easy nor probable. Falling global demand will only lessen the incentive to invest more in production. With little excess capacity, and OPEC voluntarily cutting production (potentially by millions of barrels of day more in the coming months), the global oil markets risk renewed volatility when demand recovers.

-Russia and China signed a landmark oil pipeline agreement on October 28th. The addition to the East Siberia-Pacific ocean trunk pipeline could ultimately carry up to 15 million tons of Russian oil to China per year. The agreement is significant on two levels: it signals Russia's desire to pursue the "China alternative", and it could portend a greater financial role for China in Russia's energy sector.

-finally, we might look back on October 13th as the beginning of a new era in European energy. The Times of London is reporting that the bloc will announce a European Energy Security Plan. The plan calls for: 1) the construction of a European supergrid, connecting power grids from North Sea wind farms to the Baltics, 2) the construction of two new gas pipelines, connecting Caspian and African gas to the bloc, and 3) a "Community Gas Ring", which would essentially allow for the pooling of European gas supplies in the event of supply disruptions. These measures will directly address import diversification (particularly in natural gas, and specifically away from Russia), security of supply issues, and fragmented national power grids.

This is a highly ambitious plan, and in my opinion, one that has absolutely no chance of being carried out in its entirety. The pipelines just aren't commercially viable yet. Furthermore, the national regulatory and interest-group challenges to EU-wide liberalization in the energy sector are formidable, and to date have blocked any substantive effort towards a single European energy market. The political will simply isn't there in France/Germany/Italy, and national interests always trump regional considerations in European energy. Despite my pessimism, the Plan is an important development, if for only one reason: it coincides with the resumption of talks between the EU and Russia over their economic and energy relationship. It looks like the EU may have finally come around to playing hard ball with Russia, and utilizing its leverage over Russian security of demand. Stay tuned for updates on these discussions over the coming weeks.

Labels: China, commodities, energy, Euro, Europe, natural gas, OIL, Russia

Tuesday, November 11, 2008

Permutations on a theme:

1) The Palms: Pruned visits Dubai for the first time.

2) Atlantis Rising: the making of an artificial archipelago.

3) Beached: the self-replicating, self-similar geology of Chicago's mercurial edge.

4) Trailing Suction Hopper Dredgers: the sort of seafaring vessel you need to rehabilitate dying beaches, fortify riverbanks, recontour ports and harbors, construct offshore multi-terminal airports or realize a real estate developer's wettest wet dream.

5) Climate Ghettos: some will be saved and some will simply drop to the sea.

6) The Army Corps of Engineers: The Game.

7) The Sands of Singapore: on mineral piracy; the then still booming global construction industry; immigrant topographies; and of course, Kiefer Sutherland in 24: The Movie.

8) Galveston on Stilts: a proto-Archigram city in quasi-flight.

9) Real Estate for the Future: setting the stage for the real estate boom and bust, the cycle of irrational exuberance and spectacular crash, ~10,000 years from now.

10) The Retreating Village: disaster urbanism.

11) Pure Geography: an oceanside trail in Chile that is knocks-you-unconcsious-and-petrifies-your-soul-as-if-falling-eternally-into-the-abyss terrifying.

12) Venice on Stilts: another proposal to save La Serenissima.

13) Sand Wars: “industrial Brindisi” vs. “elegant, baroque Lecce”.

14) The Great Climate Change Park: on Ashley Kelly and Rikako Wakabayashi's winning entry for the Envisioning Gateway competition.

15) Microcoasts: Vicente Guallart's orthogonal paramecium genetically modified with an Autobot's DNA (or not).

16) A Field Guide to the Public Beaches Of Malibu: how to access your beach.

17) Fish Works: aquaculture in Brooklyn.

18) 10 Meters of Extended US Coastline: a temporary art installation by Danish artist Nikolaj Recke.

19) Operation Beachhead: Andrew Stacey's photographs of coastal fortification at Happisburgh, England.

20) Constituency of Ignorance: quoting at length Cornelia Dean's Against the Tide.

21) “A new approach to management of the American shoreline is urgently needed”: again quoting at length Cornelia Dean's Against the Tide.

22) Coastal Retreat: from a vernacular architecture of Victorian social conventions to a zeitgeist architecture of fiscal sobriety.

23) Other Bathing Machines: King Alfonso's architecturally riotous beach furniture.

24) Anti-Tsunami Landscapes: what if the Army Corps of Engineers hired Peter Eisenman.

25) This House Turns and Returns, Too: the future adaptive re-use of the future Pavilion of the Netherlands, designed by John Körmeling for Expo 2010 Shanghai.

26) Nomadic Hotels and Lighthouses: wishing there was YouTube in the 1880s.

27) The Supersurface of Architectural Diaspora: of course.

28) Turkey Point Canals: a nuclear power plant's cooling canals, which are also part of a wildlife preserve for rare alligators.

29) Traces and Trajectories: Smout Allen's Retreating Village returns briefly.

30) Ebola Island: hilarious, if not frightening.

Super-Slurry

Labels: archive_diving, littoral