|

|

|

|---|

Friday, January 30, 2009

Rory and I have both made our views clear on the recent resurgence of protectionist measures in G20 countries so, instead of spouting off once more, I think it's worth looking at the arguments at work on both sides. Via Megan McArdle:

Proponents of expanding the "Buy American" provisions enacted during the Great Depression, including steel and iron manufacturers and labor unions, argue that it is the only way to ensure that the stimulus creates jobs at home and not overseas.... The proposals are meant to regenerate heavy manufacturing jobs in the United States by forcing government contractors to use domestic materials and equipment, even if they are more expensive.The logic here is that, in order to prevent stimulus money from leaking abroad, one must spend money on domestic goods. These are, after all, the workers and firms who are going to be hard-hit by this recession. But does anyone else find it odd that these proponents are suggesting that the best way to deal with a consumer-driven recession is to make things that are more expensive? And yet that's what we're seeing once again with the proposed additions to the economic stimulus package that was voted through the US House of Representatives yesterday (see Rory's post below).

It's interesting to see how the arguments for protectionism have changed so little over the years. Thanks to the wonders of the internet, I have managed to track down a biting critique of protectionist logic by 19th century French writer Frédéric Bastiat. In his book, Economic Sophisms, (available at EconLib) Bastiat used his humour and wit to ridicule the policy proposals of his day. Below is Bastiat's essay: "A Negative Railroad" - see if you can draw parallels with today!

I have said that as long as one has regard, as unfortunately happens, only to the interest of the producer, it is impossible to avoid running counter to the general interest, since the producer, as such, demands nothing but the multiplication of obstacles, wants, and efforts.

I find a remarkable illustration of this in a Bordeaux newspaper. M. Simiot raises the following question:

Should there be a break in the tracks at Bordeaux on the railroad from Paris to Spain? He answers the question in the affirmative and offers a number of reasons, of which I propose to examine only this:

There should be a break in the railroad from Paris to Bayonne at Bordeaux; for, if goods and passengers are forced to stop at that city, this will be profitable for boatmen, porters, owners of hotels, etc. Here again we see clearly how the interests of those who perform services are given priority over the interests of the consumers.

But if Bordeaux has a right to profit from a break in the tracks, and if this profit is consistent with the public interest, then Angoulême, Poitiers, Tours, Orléans, and, in fact, all the intermediate points, including Ruffec, Châtellerault, etc., etc., ought also to demand breaks in the tracks, on the ground of the general interest—in the interest, that is, of domestic industry—for the more there are of these breaks in the line, the greater will be the amount paid for storage, porters, and cartage at every point along the way. By this means, we shall end by having a railroad composed of a whole series of breaks in the tracks, i.e., a negative railroad.

Whatever the protectionists may say, it is no less certain that the basic principle of restriction is the same as the basic principle of breaks in the tracks: the sacrifice of the consumer to the producer, of the end to the means.

Labels: protectionism, the Academy

Does it matter if an already worthless currency is abandoned?

Labels: Currencies, Inflation, Monetary Policy, Zimbabwe

Thursday, January 29, 2009

On Wednesday I poked fun at the hypocrisy of Vladimir Putin's Davos speech. Despite this, his warning on the dangers of protectionism should be heeded by policymakers, particularly in the US, especially now.

On Wednesday I poked fun at the hypocrisy of Vladimir Putin's Davos speech. Despite this, his warning on the dangers of protectionism should be heeded by policymakers, particularly in the US, especially now.

The US House yesterday passed the $819 billion stimulus package, known as the American Recovery and Reinvestment Plan (I love the use of the word "reinvestment", you just know it focus-grouped so much better than "exploding deficit"). The vote was along party lines; not a single Republican voted for the package. The debate over the contents and balance of spending/tax cuts is endless, and I won't wade into those waters here. But I am very troubled by one aspect of the bill: the now notorious "Buy America" clause (which, I must boast, I was all over from the beginning). What at first looked like a shameful attempt at backdoor protectionism, is now officially on the table. It passed.

We know that the House version of the bill is different from the one the President will ultimately sign. It is likely that many of the "pork-lite" programs will be shed to deflect widespread criticism over their relevance to the immediate economic crisis. But in all the partisan back and forth, I have yet to hear a passionate criticism of the "Buy America" clause. The Republicans are more outraged by $335m in funding for sexual health education and prevention programs. The silence on "Buy America" is dangerous and increases the likelihood that the clause remains in the final version. It also provides a fundamental test of Obama's trade policy, whatever that might be. Megan McArdle and Dani Rodrik agree.

Luckily, the European Commission has a bit of a problem with "Buy America" (Canada too). Peter Powers, Commission spokesman, warned, "If a bill is passed which prohibits the sale or purchase of European goods on American territory, that is not something we will stand idly by and ignore." Furthermore, the European Confederation of Iron and Steel Industries (Eurofer), a powerful lobby representing over 370,000 EU workers, has called on the EU to bring it to the WTO, saying, "Our view is that if passed this would be a clear violation of their WTO commitments on government procurement rules", and, "It is a protectionist measure which goes against the commitment made to the G-20 to keep markets open."

Dave was spot on when he said of this rising protectionism, "the real danger is that tariffs/bans on stuffed kittens and fancy cheese are the first snowballs that kick off an avalanche of protectionism that smothers trade and damages geopolitical relations." But what if that avalanche is exactly what we need? Could "Buy America", cheese duties, and stuffed kitten tariffs be the sparks that finally break the DDA deadlock? A rapid deterioration in the trading system could compel leaders to look past the modalities and embrace the central role of trade in saving the global economy.

Maybe. We've learned that a crisis is often necessary to force policymakers out of their comfort zones and stand up to powerful interests. At the very least, a little pressure from the across the Atlantic might bring US policymakers to their senses.

UPDATE: The FT reports that the "Buy America" clause is not present in the current Senate bill, but Senators like Sherrod Brown of Ohio are pushing for its inclusion. I mistakenly assumed it was.

(Photo: funkandjazz)

The Pittsburgh Steelers will face the Arizona Cardinals in this Sunday's Super Bowl. To our readers from everywhere but North America, that's the championship game of the sport where the ball bounces funny (no, not rugby).

As everyone knows, Barack Obama is from Chicago. That makes him a Bears fan. But that hasn't stopped the press from asking who he's rooting for in the big game. His answer?

''Other than the (Chicago) Bears,'' Obama said, ''the Steelers are probably the team that's closest to my heart.''

You might be asking yourself, how does a guy who was born in Hawaii, lived in Indonesia, attended college in L.A. and New York, law school in Boston, and spent his adult life in Chicago become such a sentimental Steelers fan?

Well...Pittsburgh=Western Pennsylvania/Eastern Ohio media markets=key electoral battlegrounds=2010/2012 elections=Steelers fans are really, really important in American politics.

If it sounds trivial, you've never met this guy: Football matters.

Football matters.

VoxEU.org has a new initiative aimed at influencing the agenda of the next G20 meeting in April. Good for them. It's great to see the acedemia harnessing the internets to take seriously the issues facing our global economy.

However, in the event that they influence the ideas put forward by the G20, there's no guarantee that our political leaders will actually, ya know, do anything about it.

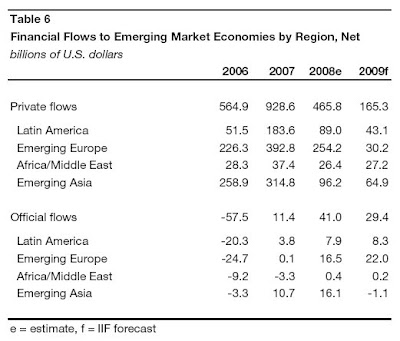

Today's statistical indicator has been brought to you by the Institute of International Finance, an association of financial institutions. 82% is the projected decline in private capital flows to emerging market (EM) economies in 2009, compared to 2007 (full report here). They now estimate flows of $165 billion, compared to $466 billion last year and $929 billion during the boom year of 2007. That's quite a drop.

Particularly hard hit will be Eastern Europe and Russia - countries that rely heavily upon external financing. Also interesting is their set of explanations for how emerging market financial institutions were hit so heavily last fall despite the fact that they weren't badly exposed to mature-market lenders. It shows very clea rly how financial problems in one part of the world can filter throughout global credit markets quite easily.

rly how financial problems in one part of the world can filter throughout global credit markets quite easily.

Furthermore, there is a danger that emerging markets in need of financing will be "crowded out" by the now massive borrowing needs of the G7 countries. Despite the huge amounts of debt they are taking on, the returns on bonds of G7 countries are still fairly low, indicating that investors still consider them safer than the alternatives. One of those alternatives is, of course, emerging markets.

The good news, according to this report, is that financial surpluses from earlier growth is giving EM economies more space for counter-cyclical monetary and fiscal policies. Moreover, while the commodity boom-now-bust has hurt some (oil-producing) EM economies hard, it's making the recovery of other (oil-consuming) EM economies easier.

But overall, the report suggests that things are looking pretty fragile, particularly for governments with little or no access to international debt markets (Argentina, Venezuela, Ecuador, Hungary, and others). This means that there will be greater need for official lending from the IMF (which has already stepped up to the plate with a whole range of new programs) as well as financing from regional development banks and bilateral agreements.

So just as private lenders in G7 economies have seized up, leaving the responsibility for economic recovery upon the shoulders of governments, so it will have to be with EM economies. Let's just hope that our official lenders are up to the task. If not, they should be given the tools they require.

(Table taken from p.7 of quoted report)

Labels: emerging markets, IMF

Wednesday, January 28, 2009

Russian Prime Minister Vladimir Putin used his podium at the World Economic Forum to attack the dollar's supremacy, skewer Wall Street bankers, and call for a new global energy paradigm. He also layed the smack down on Michael Dell.

But it was his warning against excessive state intervention in response to the global economic crisis that really caught my attention. His statement was, um, interesting:

"Excessive intervention in economic activity and blind faith in the state’s omnipotence is another possible mistake."

Huh. Putin, excessive intervention, blind faith in state's omnipotence. I feel like these things are related.

Labels: Davos, energy, financial crisis, nationalism, protectionism, Russia

For those you with short memories: a reminder about the G20 meeting from late 2008. Among the many fine words put forward following the November summit, there is one collection that seems worth revisiting. Declaration #13 reads (ahem):

We underscore the critical importance of rejecting protectionism and not turning inward in times of financial uncertainty. In this regard, within the next 12 months, we will refrain from raising new barriers to investment or to trade in goods and services, imposing new export restrictions, or implementing World Trade Organization (WTO) inconsistent measures to stimulate exports.Given the near-universal consensus on the detrimental contagion effects that protectionist measures have on global trade and material well-being, this was not particularly earth-shattering. Still, it was nice to see our political leaders re-affirming their commitment to...

Oh bugger! it took only three days before we heard serious talk in America about bailing out the automotive industry. This was followed shortly by the lawmakers considering a "buy US steel provision" for TARP funds. Meanwhile, in China, there is the small matter of currency manipulation and using the fiscal stimulus plan to promote domestic industries.

Not to be outdone, India has stepped up to the protectionist plate (wicket?) to take a few swings. Yesterday, India's government banned Chinese toy imports for six months - all six which fall into the twelve month period of no-import barriers promised above. From Free Exchange:

What the [Indian] government is thinking is unclear. In a grave speech at the G20 meeting in November, India’s prime minister urged the group to "forestall any protectionist tendencies which always surface in times of recession". The G20 seems to take India seriously. But India doesn’t seem to feel the same way about the G20.Unfortunately, the same can be said for many of the G20's members. Of course, if all Chinese toys posed a serious health hazard in some way maybe this could be justified. But is it likely that all Chinese toys are dangerous? If so, India's government should be presenting their evidence to the WTO, not taking the path of least domestic political resistance and implementing a complete ban. Incidentally, this is also the path towards a trade war with one of the world's largest exporters.

Now I'm guessing the toy industry does not represent a significant portion of China's GDP, but that's not really the point. As The Economist's in-depth look at the infamous Smoot-Hawley bill of 1930 made clear, the real damage comes from how such laws sour trade relations, leading to retaliatory effects. Just look at what happened last week with French cheese.

So let's leave aside for the moment how such actions undermine the G20 and provide yet further evidence for the calculated hypocrisy of our political leadership. The real danger is that tariffs/bans on stuffed kittens and fancy cheese are the first snowballs that kick off an avalanche of protectionism that smothers trade and damages geopolitical relations. It is precisely now, in this economic turmoil, when international cooperation is needed more than ever.

Labels: China, G20, India, international trade, protectionism

Monday, January 26, 2009

Over 70,000 jobs were cut on what the FT calls "one of the gloomiest days in the global economic crisis so far". The size and global scale of the job losses are staggering. Raymond Torres of the ILO explained the situation in this way:

“We have a vicious circle of depression, where job losses lead to falling consumption, which lowers industrial confidence, which leads to less investment, which results in more job losses, and so on.”

As a recent masters graduate still looking for employment, that's some really bad news.

Labels: financial crisis, investment, labor

As expected the Panamera will most likely share a similar front to the rest of the Porsche lineup, however the car is inherently different to the rest of the German stable.Unlike the 911, the Panamera is a conventional front-engined rear-wheel drive that will become Porsche’s Grand Tourer. The car will be put together in Porsche’s Leipzig facility with the engines originating from Stuttgart and the car’s painted shell crafted in Hanover by Volkswagen.

Porsche will compete directly against its German and Italian rivals such as the Mercedes-Benz CLS 63 AMG and Maserati Quattroporte. There is also the possibility of taking sales away from the Bentley Continental GT, Aston Martin Rapide and even the Ferrari 612 Scaglietti .

Porsche insiders have said the Panamera range will include at least three engine choices, Volkswagen’s 3.5-litre six-cylinder, which develops a healthy 223kW and Porsche’s own direct-injection eight-cylinder petrol engines, available in naturally-aspirated guise (261kW) and with twin-turbos (417kW).

The space available inside the car offers a brand-new experience of roominess. The two sporting and comfortable single seats at the rear will allow adults to relax with surprisingly generous headroom, in full comfort and, if they wish, with all the performance and speed of a genuine Gran Turismo.

Dr. Ing. h. c. F. Porsche AG, Stuttgart, will also be building a hybrid drive version of the new Panamera. This four-door Gran Turismo with sporting driving dynamics so typical of Porsche will boast the proven components featured in the Cayenne Hybrid entering the market at the end of the decade. And thanks to its newly developed full parallel hybrid, Porsche’s Sports Utility will offer average fuel consumption of less than 9 litres/100 kilometres.

The newly developed full parallel hybrid system will consist primarily of the battery unit positioned in the luggage compartment, the power electronics, and the hybrid module between the engine and transmission comprising an additional clutch and the electric motor. Depending on driving conditions, the hybrid module is able to disengage either the combustion engine or the electric motor, or to combine both drive systems as one joint power unit. Hence, the Panamera may be driven in a number of different modes ranging from all-electric drive absolutely free of emissions all the way to the sporting style of motoring so typical of a Porsche.

Labels: Porsche

- "The mood is going to be somewhat sober" at the Davos World Economic Forum this year, which starts on Wednesday. No kidding. In that vein, the WEF's opening speaker is someone not known for his overwhelmingly upbeat rhetoric: Vladimir Putin.

- John Hempton at Bronte Capital thinks we should stop fiddling around with metaphors and literally drop money from helicopters to induce inflation fears. Sure some people may accidentally die from the falling money packages, says John, but it might also induce consumer spending. Or, you know, cause foreign investors to dump all their US assets.

- A good discussion over at Free Exchange over whether the euro-zone is a modern day gold bloc - referring to the rigid constraints of the interwar gold standard that delayed economic recovery in 1930s Europe and beyond. The short answer is no, it is not. The takeaways:

"...because the break-up of the eurozone would involve unacceptable financial damage, the ECB and member governments are committed to the rescue of flailing national economies. Europe cannot allow Ireland or Spain to collapse, and so presumably, international capital will treat those states differently than they might Britain, which is stuck out there by its lonesome."Moreover, the gold standard had no institutional equivalent of the ECB to help facilitate coordinated monetary easing - something that was a real sticking point. This doesn't mean the euro-zone is entirely in the clear, just that it has a set of challenges distinct from any historical precedent.

- Democracy woes from the pages of the WaPo: social unrest in Eastern Europe, and Bolivia's new constitution.

Labels: Davos, Euro, Monetary Policy

Sunday, January 25, 2009

Politique

-On Tuesday, Barack Obama became the 44th President of the United States. Or was it Wednesday? He swiftly moved to roll back the Bush years through executive orders on Guantanamo, interrogation, and foreign assistance. The President also named two high profile envoys to the middle east and south Asia, a signal that the State Department and America's "soft power" will lead US foreign policy.

-Israel completed its withdrawal from Gaza, days after both Israel and Hamas declared "unilateral" ceasefires. The death toll from the conflict is estimated at 1,300 Palestinians and 13 Israelis. In related news, the BBC came under intense pressure following its refusal to broadcast a Gaza aid appeal by the Disasters & Emergency Committee.

-The Prime Minister of Iceland, Geir Haarde, called a March general election and will not seek reelection. The Daily Mail (and many others) incorrectly labeled Haarde's government the "first in the world to be effectively brought down by the credit crunch." As Dave noted in December, Belgium's government was the first to fall under pressure directly stemming from the financial crisis.

Economia

-Negotiations over the US stimulus package intensified as Obama met with leaders from both parties to shape a consensus. The stimulus package will undoubtedly pass, but what will it look like: will it hit $1 trillion (many economists believe it must to be effective)? how large are the tax cuts (will Obama bend to his own party by limiting this political manoeuvre)? how many Republicans will ultimately be on board?

-Spain and Portugal were hit with downgrades this week, and the eurozone looks to be on the verge of a serious crisis of confidence. Following its second bail out of the banking sector and the Pound's sharp decline, is the UK in the firing line? Does Britain=Iceland?

-In a written statement to the Senate Finance Committee, US Treasury Secretary designate Timothy Geithner accused China of "manipulating" the renminbi. In a measured response, the Chinese government said Geithner's comments were "out of keeping with the facts", would undermine the global effort to combat the financial crisis, and could fuel protectionism. In other China news, year-on-year GDP growth slowed to 6.8% in the 4th quarter, the slowest pace in 7 years.

The Rest

-Holders Pompey crash out of the FA Cup, Arsenal are held at last year's finalists Cardiff City, and the Merseyside derby ends in a draw, setting up a 4th round replay. In other Prem news, Kaka's megadeal to Man City fell through and a Kuwaiti consortium's proposed takeover of Liverpool has reportedly collapsed.

-In other sporting news, the disturbing balkanization of grand slam tennis.

-Affirming Dave's "political economy theory of fashion", Milan fashion week reflected the economic downturn, with the suit notably absent from many collections.

-The 81st Academy Awards nominations were announced in Los Angeles. The Curious Case of Benjamin Button lead the pack with 13 nominations, followed by Slumdog Millionaire with 10.

-Blackberry addicts the world over are scrambling to get their hands on the "Barackberry", after the US President finally wins his battle to stay connected in the White House. The NSA-enhanced device will have two "modes": one for personal contact with a tiny group of family and friends, another for official communications with a small circle of advisors and officials.

Labels: Arsenal, China, Currencies, economia, FASHION, financial crisis, fiscal stimulus, Football, Obama, sport

Saturday, January 24, 2009

Maybe I'm losing my memory, but somehow I don't remember these parts of the speech...

The forester of Subaru was called much things, but a thing which it is never called is beautiful. That all can change for 2009, when the forester undergoes his first ground-towards the top remade, by comprising a three-inch-length footing, three inches additional length, and recognition, all-new, to name macho more. What will not change is its large carriage, raise-suspension programs, but of the '09 model off-roading possibilities should be intensify-literal-thank with aucuns less than 8.9 inches for ground clearance. The behavior of assistance of on-road is its stiffer and all-new platform, which uses a new suspension of back of double-fork for the improved driving back prowess.

As with the standard model, 'forester 09 will be actuated by a choice of the four cylinder motors of boxer, each 2.5 naturally aspired liters of displacement and available in both and of the forms turbocharged. Better news is always that they will continue to be offered with a manual transmission, maintaining with the assistance of beginning of slope . Ah, and naturally, being Subaru, the forester will send anywhere never his power if not to each of the four wheels.

The forester will be available in a series of savours, of the low forester X to the bean edition of range- crimage L.L. Each one will draw benefit from a more roomy fuselage returned out of materials more high-quality designed to outdistance it its econo-car beyond that. The new interior devices and options include the fabrics double-piqu s of seat, the audio, and-final-a advanced systems the navigation system. Little of the summary of safety crossing also becomes include the standard ordering of stability, in addition to the bags of air of surround-sound with a probe of inversion.

Labels: subaru

Friday, January 23, 2009

Marginal Revolution brings my attention to a PBS interview with Warren Buffet in which he summarizes what a lot of people are thinking about the tax cuts vs. fiscal spending debate, but no policymaker worth his/her salt will dare utter in public:

SG: But there is debate about whether there should be fiscal stimulus, whether tax cuts work or not. There is all of this academic debate among economists. What do you think? Is that the right way to go with stimulus and tax cuts?

WB: The answer is nobody knows. The economists don’t know. All you know is you throw everything at it and whether it’s more effective if you’re fighting a fire to be concentrating the water flow on this part or that part. You’re going to use every weapon you have in fighting it. And people, they do not know exactly what the effects are. Economists like to talk about it, but in the end they’ve been very, very wrong and most of them in recent years on this. We don’t know the perfect answers on it. What we do know is to stand by and do nothing is a terrible mistake or to follow Hoover-like policies would be a mistake and we don’t know how effective in the short run we don’t know how effective this will be and how quickly things will right themselves. We do know over time the American machine works wonderfully and it will work wonderfully again.

SG: But are we creating new problems?

WB: Always

Ouch. This is why economics as a profession can never aspire to being a "hard science" like physics or biology: there is simply no way to conduct a closed-lab experiment on the effects of these policies. Hayek recognized this fact and emphatically discouraged attempts to quantify the economy in absolute terms - what he called "The Pretence of Knowledge." The essential complexity of economic phenomena and their interaction with the real world forces us to rely on qualitative linkages and partial data.

The implications are twofold. It means that policymakers cannot engineer a lasting state of full employment, as some of those who call themselves "Keynesians" have tried (and failed) to do through active government intervention. These are some of Hayek's clear targets in his Nobel Prize speech.

But it means equally that policymakers cannot engineer permanent economic growth through widespread deregulation that relies entirely upon private actors' self-interested decisions and risk management techniques. Left to their own devices, some of the world's largest financial institutions have leveraged their assets 30 and 40 times - often using financial instruments that were often too complex to understand, yet not complex enough to fully account for risk. One does not have to be a mathematician to see the consequences of this: countries like Iceland, Ireland, and the UK dealing with financial-sector liabilities worth many times their respective GDPs.

So when Rory and I created the tagline for this blog, we were not referring the creation a new paradigm at one or the other end of an ideological spectrum. Instead, what we're try to do is stimulate discussion that will lead to sensible, practical ideas that can help us muddle through the diffucult problems of the day. In order to accomplish that, acknowledging the limits of economics as a predictive science is a good start.

- 440%: roughly the amount of debt-to-GDP that the UK would be taking on should they move to nationalize their major banks. This would be in addition to projected deficits of around 10% of GDP. (Maverecon & NYT)

- 6.8%: China's year-on-year growth rates in Q4, compared to 9% in Q3 and the lowest in seven years. How do you say "hard landing" in Mandarin? (RGE Monitor)

- $450 billion: the total value of assets shed by the hedge funds last year, equivalent to 37% of the industry. (Bloomberg)

- 5 million tonnes: the amount of rice that Thailand is considering selling from its stockpile, or 20% of the world's annual trade in rice. Depending upon how it is managed, a sell-off of this size has the potential flood the market and lower the price significantly. Good news for importers of rice, surely; less good for rice farmers. (Financial Times)

- 3: the number of times I've listened to/read Barack Obama's innauguration address. I cannot pick out a better line than the one Rory has chosen below, but two more sections deserve special attention:

"...we reject as false the choice between our safety and our ideals"

"Starting today, we must pick ourselves up, dust ourselves off, and begin again the work of remaking America"Yes. And the same goes for the rest of us.

Labels: China, commodities, financial crisis, hedge funds, United Kingdom

Thursday, January 22, 2009

Upon reflection, two things will stick with me forever.

A single line, perfectly encapsulating the moment:

"What the cynics fail to understand is that the ground has shifted beneath them..."

Brilliant.

And a single image. It is the first photo of the new president at his desk, dwarfed by the enormity of the office and task that lay ahead of him.

Labels: Obama

According to the Times of London, one of former US President Bush's final acts in office was a 300% increase on the punitive duty on Roquefort cheese imports from France. Mmmm, cheese.

Anyway, this was accompanied by increases on a variety of EU food imports, including fruit, chocolate, and chewing gum. The Times reports this as further punishment for Europe's 12 year ban on US hormone-fed beef. Some in France believe it extends back to France's lack of support for the invasion of Iraq. If true, US logic is brilliant- hit them where it hurts...cheese!

As if the new US duties weren't troubling enough, the European reaction threatens to ignite a full blown culture war. From the Times:

Philippe Folliot, a centrist MP for the area around the village of Roquefort, called for a super-tax against Coca-Cola.

Touche, France.

Labels: international trade, protectionism

The term political economy was first used in France in 1615.

This comes from Jerry Muller, a professor of intellectual history, but Wikipedia backs him up.

Also worth a read is their article on IPE. Interestingly, under the "Origins" section there is no mention of either Susan Strange or Robert Gilpin, yet there is mention of someone named Eugene Low. Anyone heard of him?

Labels: IPE

Wednesday, January 21, 2009

Last year, the above photograph of the Tarim Desert Highway in western China was used to decorate a post in our now retired Prunings series. We've always thought that it should have its own separate post, so here it is.

As described by Wikipedia, the highway “crosses the Taklamakan desert from north to south. The highway links the cities of Luntai and Minfeng on the northern and southern edges of the Tarim basin. The total length of the highway is 552km; approximately 446km of the highway cross uninhabited areas covered by shifting sand dunes, making it the longest such highway in the world.”

“In 1994,” says People's Daily Online, “the Tarim desert highway was expanded to the central area of the Tarim Basin, and the completion of the central Tarim oil-gas field, the largest of its kind in China, will make Xinjiang become a strategic substitute area for China's oil and gas resources. Following this, the highway continued to expand in the desert and has turned into a macro-artery for bringing along the economic development in southern Xinjiang.”

In other words, it plays a key role in the country's energy security. And if we may be allowed to indulge ourselves for a moment and parse that last sentence, the highway is also an important tactical infrastructure of pacification through which state control, in the guise of “economic development,” can easier be meted throughout the mainly Muslim and violence-prone region.

To protect this supposedly strategic highway from getting buried by the encroaching sand dunes, rows of vegetation were planted on both sides of the road. An extensive irrigation network was laid down to sustain this artificial ecosystem, pumping water from underground reservoirs and then distributing it throughout. Although the water has a high saline content, this greenbelt has successfully taken root. The desert blooms.

While we cringe at reading that this greenbelt has somehow “improved” the ecology of the desert, it would be worthwhile to track down some of the research that were conducted in preparation for the project. We might, for instance, find out some new techniques that would help plants survive extended periods of drought. We're also interested in their plant list. Perhaps they have discovered that some species, previously not known for their hardiness, actually have a high tolerance for sandy soil and salty water, and then later, have genetically modified them to improve their survival rates. And who knows, maybe their experiments are paving the way for food crops, not just ornamental ones, to be cultivated in deserts and watered with sea water.

Considering that climate change will turn many places into deserts, these Tarim xeriscapers could offer us some helpful advice in adapting to our arid future.

And what's happening in the photo above? At first glance, we thought that they had covered the desert with hardscaping material, but on closer inspection, those are just rows of plants.

Still, we're hoping that someone will come along and leave a comment saying that for large sections of the highway where the vegetation cannot take root, the Chinese government had hired someone to pave over the dunes, a sculptor wanting to stop the migrating dunes dead on their tracks as a kind of long-form performance art. And then, due to several bouts of heatstroke and because that abrasive sand keeps getting into his crotch all the time, he just went out of control.

He's now concretizing the whole desert!

Meanwhile, notice the red-roofed blue buildings. According to National Geographic, they “appear every few miles [and] house workers who maintain the greenbelt.” The workers sign up for stints that may last up to two years. They may be with their spouses or get paired up with someone else, but essentially, they live solitary lives, an eccentric group of monastic botanists in a mystical struggle to arrest this ephemeral landscape in time and space.

On the topic of Obama and the market, it seems one company is already feeling the impact of an Obama stimulus.

Shares of J Crew Group Inc. ended the day up more than 10% on the news that J Crew was the prefered inauguration outfitter of the Obamas. The Prez: white satin bow-tie. First Lady: gloves, sweater, skirt. Girls: coats, dresses, accessories. Not since Camelot has a First Family made such an impact on the fashion world.

I think Obama's stimulus strategy is clear. Expect to see him driving a different GM vehicle each day, ditching Air Force One for US commercial airlines, opening brokerage accounts at Citi and BofA, and buying up beach houses across the country.

Labels: FASHION, fiscal stimulus, Obama

One of my conservative friends remarked yesterday that the Dow's 4% decline should be chalked up to the market's fear of an Obama presidency. I could go at this statement on so many levels. I instead went looking for the historical context of yesterday's performance.

David Gaffen at MarketBeat looked at the Dow's inauguration day performance since 1937 (excluding Obama, his article was published yesterday afternoon), the year inauguration was moved to Jan. 20th. He concluded that "the day of the inauguration has historically been a lousy one for the Dow Jones Industrial Average." He found that out of the past 10 inaugural days, just 2 ended higher for the Dow (85 and 97). The worst day? The Gipper's 1980 inauguration.

So if recent history is any indication, Obama had little to do with yesterday's decline. It was instead driven by a heavy sell-off in financials, which speaks more to the Bush administration's utter failure to address the fundamental problems in the banking sector and place a floor under the US housing market.

Labels: equity markets, financial crisis, market psychology, Obama

-From the Times of London: Fatah leader Mahmoud Abbas is claiming that he was President Barack Obama's first call to a foreign leader. How does he know? Well, Obama told him so. I was highly critical of then President-elect Obama's silence on Israel's operations in Gaza, so I will be the first to say that, if Abbas is correct, Obama has made a very welcome statement on his commitment to the peace process. Apparently, Obama's first round of foreign calls were to middle east leaders (Egypt, Jordan, Israel), signalling to many that the new US prez is serious about renewed US leadership in the region. On a related matter, in case anyone doubted the political considerations driving Israel's Gaza offensive, the pullout from Gaza was completed today, Obama's first day in office.

-Portugal became the third eurozone country in two weeks to be hit with a downgrade. S&P cut the country's rating to AA minus. According to the FT, the cost of insuring Portugese government bonds through credit default swaps has risen to a record high. The government quickly labeled the downgrade as "unreasonable." In the past week, S&P has issued reviews on 10 highly rated western countries, leading Wolfgang Munchau to ask"what if" a eurozone economy defaulted?

-Foreign Policy has published the Think Tank Index, developed by the IR Department at the University of Pennsylvania. It is advertised as the "first comprehensive ranking of the world’s top think tanks, based on a worldwide survey of hundreds of scholars and experts." Below, the top 5 US and non-US think tanks:

US--> 1. Brookings Institution, 2. Council on Foreign Relations, 3. Carnegie Endowement for International Peace, 4. Rand Corporation, 5. Heritage Foundation

Non-US--> 1. Chatham House, 2. International Institute for Strategic Studies, 3. Stockholm International Peace Research Institute, 4. Overseas Development Institute, 5. Centre for European Policy Studies

Labels: Euro, financial crisis, Middle East, Obama, sovereign debt

Tuesday, January 20, 2009

Minutes after posting my look at sterling and the prospects for Britain joining the common currency (see below), Nick Clegg steps out and validates one half of my conclusion: the debate will seriously reemerge during 2009.

In an interview with the FT, the Lib Dem leader echoes the main conclusions of the "10 Years of the Euro: new perspectives for Britain" report, arguing that Britain must join the Euro to "salvage the public finances and prevent the 'permanent decline' of the city." He believes public opinion could swing violently in favor of the euro should the pound's volatility continue in the face of the euro's relative stability.

“In that context of people just longing for clearer rules, for reliability, for stability, for certainty, you might just find that becoming part of the reserve currency on our doorstep might become part of the recipe . . . by which we put the British economy back together on a more sustainable footing.”

This is a bold position for the Lib Dem leader, sure to provide him with the spotlight in the days to come. Unfortunately for Clegg, his authority to influence such a decision is nonexistent. The Lib Dems occupy a seemingly permanent minority position and Clegg himself has failed to distinguish his leadership since succeeding Ming in 2007. The buzz in Westminster is that the Lib Dems are engaged in backroom negotiations with the Tories over a possible coalition government should the next general election result in a hung Parliament (conservative win short of a majority). But a Tory minority government would be an unlikely partner for the Lib Dems on Europe in general, and especially so on Euro accession.

Regardless of his or his party's prospects, Clegg has thrust Euro accession back into the British political discussion. I am eager to see how Brown and Cameron respond.

Labels: Currencies, Euro, financial crisis, United Kingdom

In the currency markets, the British pound has been one of the biggest victims of the financial crisis. It is down almost 30% against the USD over the past 12 months, and is hovering near parity with the Euro for the first time since the common currency's inception. The explanations are numerous: no horizon for the financial crisis, housing prices in free fall, fears of prolonged deflation, the BoE chasing the Fed, swelling deficits, etc etc etc. All the standard culprits.

In the currency markets, the British pound has been one of the biggest victims of the financial crisis. It is down almost 30% against the USD over the past 12 months, and is hovering near parity with the Euro for the first time since the common currency's inception. The explanations are numerous: no horizon for the financial crisis, housing prices in free fall, fears of prolonged deflation, the BoE chasing the Fed, swelling deficits, etc etc etc. All the standard culprits.

While confidence in the UK economy, and currency, has been falling for some time (understatement of the year?), there is growing concern that a sterling run is imminent. Sterling fell below $1.40 today to its lowest level in over 7 years. Before paring losses in late trading, it was headed towards it worst day against the dollar since 1992. In a widely quoted interview, investor Jim Rogers summed up his thoughts on the pound, "I would urge you to sell any sterling you might have. It's finished. I hate to say it, but I would not put any money in the UK." Ouch. There is also speculation that the UK is facing a downgrade (Spain and Greece were downgraded last week, with Ireland and Portugal in the firing line).

In my opinion, this sterling pessimism is well-placed. Public sector debt is expected to balloon to more than 50% of GDP by 2011. The government just announced a second bail out of the banking system, a day after shares in RBS fell 66%, and amidst calls for a complete nationalization of RBS and Lloyds. While Brown has been more proactive than US policymakers in addressing the banking system (i.e. nationalization), he has yet to fully address the fundamental toxin in the system: bad assets. Until banks are compelled to fully disclose the steaming piles of crap they are sitting on, confidence in the banking system will remain nil.

So, if we are confronting a sterling collapse, what are the implications? Politically, Labour would be toast. Economically, a tiny boost to British manufacturing/exports would follow, but plunging consumer confidence and global demand would more than cancel this out. Financially, an already weakened City of London would see its influence as the global capital of finance (sorry New York) severely diminished. Fiscally, the government would find it increasingly difficult to finance its massive response to the crisis.

And what of the currency itself? One of the more interesting questions is whether a sterling collapse could lead Britain to reconsider the Euro. A group of academics, journalists, and politicians have revisited this argument in the report, "10 Years of the Euro: new perspectives for Britain". Organized by LSE Chairman Sir Peter Sutherland, and including contributions from LSE Prof and IPE Journal favorite Willem Buiter, the report argues that the country "should urgently reconsider the case for joining the single European currency". Buiter sums up his case succinctly, "It is time to revisit the five tests, to declare them passed and…for the UK to adopt the Euro." He dismisses the argument that an independent monetary policy is necessary for a country like Britain to respond to financial shocks, and discounts the effectiveness of exchange rate control by saying, "Even a gun fired at random by a drunk may, from time to time, hit the target. This is what we have seen in the UK with the exchange rate this past year."

Sutherland argues that Britain will lose its financial and regulatory influence under the emerging (re)regulatory consensus and eurozone fiscal convergence. His argument is essentially this: join the club and have a powerful seat at the table, or get left behind, powerless and throwing stones at the castle wall.

While Euro adoption may be in Britain's long term interest, is joining the Euro viable in the short term? I say no. Adopting the Euro would be political suicide for Labour, and it is unimaginable that Brown would risk his already shaky resurgence with such a bold stroke of statesmanship. The British also have an historic, deep attachment to the pound. Once the reserve and primary settlement currency under the gold standard, sterling's prestige is deeply ingrained in the British consciousness (nowhere more so than in the City of London). You could say it is the last vestige of the empire. And let us not forget that the Euro project itself will be under real strain in the coming year. Full and sustained eurozone fiscal coordination is anything but certain, and anti-Euro sentiment will undoubtedly rise in countries like Italy and Greece. Will the Euro enjoy the same credibility 12 months from now?

A lot of important questions. Luckily, sterling's decline guarantees that Euro adoption will return to the discourse in 2009. If the minds behind the report are correct, Britain should take a serious look at accession.

Picture Source: neftos

Labels: Currencies, Euro, financial crisis, United Kingdom

There's nothing like a crisis to concentrate the mind. On January 15th, a collection of influential academics and financiers - known as the G30 - released a set of eighteen recommendations for reforming the international financial system. You can browse the summary or read about them here and here.

There a couple of things that need to be said. First, unlike the other G-units you hear about in the news, the G30 is a private group that does not represent official policy. Yet. (There are a large number of members, including Geitner and Volcker, that will be directly involved in shaping policy over the next several years).

Second, the group is, with one exception, entirely male.

Third, this old boys club may very well forshadow what's to come when the other old boys clubs, the G7 and G20, meet over the next year or two. Since the early 1990s the financial architecture exercise has lurched from one crisis to the next, with each set of proposals attempting to address the causes of the previous financial meltdown. (One of the emeritus members of the G30, Peter Kenen, likened the participants to generals preparing to fight the last war). In any event, the last big set of changes occurred in the wake of the Asian financial crisis in 1997/8 and left us with the G20, the Financial Stability Forum and a collection of "best practices" standards for insurance, accounting and securities, among other things.

Since then, however, the whole movement has largely been on hold. This is difficult to avoid given that, once the last crisis fades from memory, our political leaders get distracted by other issues. Besides, the economy recovered nicely from the mild recession in 2001 and things were looking up! Well, no more. The report from the G30 signals to me that the financial architecture exercise has received a new jolt of life. I'll have more on the actual content of the recommendations a little later. For now, it's enough to note that the renewed debate over the health of the financial architecture is long overdue and, in my view at least, a very welcome prospect.

Labels: Financial Architecture, financial crisis

Monday, January 19, 2009

One of the interesting things — and there are definitely many — that you will read about in Kazys Varnelis' paean to the “networked ecologies” of Los Angeles, The Infrastructural City, is the dust control system at Owens Lake.

After decades of monumental water projects that have diverted the lake's “life-giving liquid” to quench a distant city's thirsty populace, to ensure the perfect shade of green for their lawns, and to turn their swimming pools into aqueous micro-paradises, the now parched lake has become a health hazard.

Writes Barry Lehrman, author of the first chapter:

Wind gusts above twenty miles an hour lifted over fifty tons per second of “Keeler Fog” off the lakebed. Often reaching over two miles high, these dust storms sent 130 times the United States Environmental Protection Agency's limit for particulate matter into the atmosphere, blowing the dust over 250 miles from the lake. Such storms occurred two dozens or more times each year, generally in the spring and fall. Composed of microscopic particles smaller than ten microns (PM10), the dust contains significant levels of toxic metals like selenium, arsenic, and lead along with efflorescent salts. The largest single source of PM10 pollution in the country, these dust storms were a clear threat to the 40,000 people in the immediate region.

The threat, according to Lehrman, came in the form of higher rates of cancer, respiratory disease, and eye problems.

To combat these carcinogenic storms, Los Angeles grafted onto the desiccated corpse of the lake a hydro-network as monumental as the existing network responsible for the situation it is tasked to offset: “over 300 miles of pipe (some as large as five feet in diameter), more than 5,000 irrigation bubblers, and hundreds of miles of fiber optic control cables and valves.”

[T]he dust control projects on Owens Lake is roughly equivalent to that of a waterworks for a city of over 220,000 people. Construction of the first five phases, treating the worst thirty square miles of dust-emitting soils on the playa, has cost the City of Los Angeles $425 million dollars to build. But that sum doesn't factor in the lost revenue from the water being appropriated for the project (around $15 million/year) or the operations and maintenance budget, some $10 million per year.

“[R]ising like alien plants on the terraformed lakebed,” the bubblers flood the playa with shallow water, creating the merest suggestion of a lake, a perverse reminder of Lake Owens' former self.

However superficial such observations may be, we couldn't help but see similarities between these bubblers and fountains.

Firstly, much like the fountains at Versailles, behind these water spouts is a staggering hydrological infrastructure. Among other things, Versailles had the Machine de Marley, considered the greatest engineering marvel of its time; Owens Lake is part of what is probably the greatest water engineering project of the 20th century.

Secondly, since time immemorial, fountains have been creating micro-climates, cooling gardens, palaces and sartorially bedecked aristocrats. The array of bubblers, you could say, is also a type of weather modification system: an anti-dust storm. Moreover, fountains like those at Columbus Circle in Manhattan can provide a sonic barrier, making one unaware of the tumult outside; with some conjecture, probably forced, you could say that the bubblers don't do much to make Los Angelenos more aware of the negative environmental effects their mode of living is contributing outside the city.

Thirdly, if one can only speculate that fountains have ameliorative effects on one's mental state, you probably don't need to speculate the positive health effects of the bubblers.

Fourthly, fountains like those in Rome are objects for aesthetic consumption; these ebullient and rather photogenic desert sprinklers, thanks to CLUI, have been appropriated into a staged aesthetic experience.

Lastly, and most significantly, they are the products of a complex network of intermingling social, technological, political, economic and geographical conditions, the manifestations of competing ideologies and agendas. They're not mere water features, in other words.

In any case, we recommend the book.

On fountains

Labels: aerosols, fountains, Super-Versailles, weather

Sunday, January 18, 2009

Instead of a wind farm that no one seems to want built near their homes, how about a hot-air balloon farm to generate renewable energy?

New Scientist reports that “Ian Edmonds, an environmental consultant with Solartran in Brisbane, Australia, has designed a giant engine with a balloon as its 'piston'. A greenhouse traps solar energy, providing hot air to fill the balloon. As the balloon rises, it pulls a tether, which turns a generator on the ground. Once the balloon has reached 3 kilometres, air is released through its vent and it loses buoyancy. This means less energy is needed to pull the balloon back down again, resulting in a net power gain.”

For those merely interested in hard numbers, calculations show that “a large 44-metre-diameter recreational balloon could generate 50 kilowatts, enough to supply energy to about 10 homes.”

For us, we want to see some fantastic, unrepentantly beguiling images showing vast tracts of land (or the ocean) planted with boldly colored balloons bobbing up and down, a strange buoyant forest unfurling and retreating during the day, fully resting at night.

Taking cues from Ken Smith and Kathryn Gustafson, urban parks everywhere will have their own aerial installations, generating power for the park itself, if not for the surrounding neighborhood.

Or in the urban periphery of foreclosed suburbs, now bulldozed and eradicated, reformatted as energy fields, electrifying cities and hopefully not tragically impeding bird migrations.

Labels: bubblesbubblesbubbles, energy, parks:urban

The New Ferrari Zobin Concept is a design study of a single-seater aerodynamic sportscar inspired by Ferrari Formula 1 cars. The author is Iranian engineer Siamak Ruhi Dehkordi.The Zobin design study by Iranian engineer Siamak Ruhi Dehkordi is an aerodynamic single seater with compact dimensions (4,114mm long and 1,855 mm wide).

So, if this new Ferrari Zobin concept release in the market, would you buy one?I bet it gets high bid from those rich deep pocket Ferrari fans.I just love Ferrari's car design especially when the car is red, just like my own Red MYVI SE car!

Labels: ferrari

When Bugatti started production of the Veyron back in 2005, it was supposed to build 300 examples. For a long time, that total seemed pretty ambitious considering the seven-figure price tag on the most super of contemporary supercars, but according to Molsheim, all but 50 have been built and sold. Add to that another 150 examples of the Grand Sport roadster version and you've got 450. Whether special editions like the Pur Sang, Sang Noir and Hermes are counted as part of the original production figures or considered supplemental specials is insignificant, considering that only a handful of each are to be built.

The one wrinkle that has us wondering about all of these million-dollar supercars is that it was only last March when it was announced that Bugatti had sold 220 cars (of which only 132 had been built). Given how long it took them to get to 220, that seems like one heck of an order ramp-up, particularly given the state of the global economy.

The bottom line is that if you've been dragging your feet over whether to spend that extra million on a Bugatti or not, better make your mind up fast. Like, Veyron fast.

[Source: Autotelegraaf via Autogespot]

Labels: Bugatti

The Pagani Zonda did something incredible. It proved that the supercar world did not revolve around Ferrari and Lamborghini. So to commemorate Horacio Pagani's achievement, the hypercarmaker has created one last version of the Zonda before its replacement arrives next year.

After 24 months of development, and at the urging of an unnamed Italo-American customer that already owns three Zondas, the Pagani Zonda R was created as a lightweight, track-only variant of the iconic coupe. Production is limited to ten examples with a price tag of 1.4-million euro.

Although the carbon fiber exterior is deceiving, the Pagani Zonda R only carries over 10% of its structure from its predecessors. The wheelbase has grown by 47mm, the overall length is 394mm longer and the track has been widened by 50mm.

An all-new carbon fiber monocoque resides underneath the wind-tunnel tested body, along with a forged aluminum suspension, new six-speed sequential gearbox and four aero-spec fuel pumps that feed a Mercedes-Benz AMG-sourced 6.0-liter V12. Pagani claims the new heart – nestled into the 2,425-pound R – will produce 750 hp at 8,000 rpm and 524 lb-ft of torque, for a 0-60 time of 3.2 seconds and a top speed of 248.54 mph. Air is fed into the bent-twelve through a carbon fiber air intake system, while an Inconel manifold and "F1-style" exhaust releases spent hydrocarbons and keeps engine temps in check.

Labels: Pagani

Saturday, January 17, 2009

For a few seconds this week, in between the live feeds of the spectacle in Washington, D.C. and on the Hudson River, CNN went silent. When reports of possibly another round of shelling in Gaza, its anchors and reporters had the bright idea to stop talking and let viewers simply listen in on whatever that could be heard from yet another live video feed, this one peering into the war zone from afar. No international journalists are allowed inside, so it was the best that CNN could do at breaking news reporting from the trenches.

“Is that some kind of a humming noise?” the anchor asked the foreign correspondent, breaking the silence.

We didn't hear a humming noise; we heard something droning. But was it from a surveillance UAV or the movement of tanks sonically reverberating through holy bedrock? Or was it something coming from our heating vent? Could it have been the running motor and refrigerator fans of the delivery truck parked outside our HQ? Was it coming from here or from thousands of miles away?

This apparent and quite accidental conflation of sonic and physical space led us to imagine a temporary sound installation, which would go something like this:

1) Overlay a scaled map of Gaza City on a map of Chicago.

2) Set up microphones throughout Gaza City.

3) Network these microphones individually to their own speakers in Chicago.

4) The locations of the microphones and speakers should match on the superimposed maps.

When the next major conflict erupts, turn them all on, and Chicagoans will eavesdrop on the aural landscape of another city: the whirring blades of helicopters, the whistling of mortars as they streak across the sky, the roar of burning buildings, metal grating on metal grating on rocks and dirt, the sorrowful cries and vengeful wails of widows and orphans, the crackling statics from a speaker disconnected to an obliterated mic.

Of course, where Chicagoans might listen in will depend on the orientation of the maps.

Perhaps this twinning results in one speaker getting sited on a school playground, and so the joyous screams of children there will mingle with those of telepresent children playing during the brief lulls in the fighting.

How about a speaker on Federal Plaza, right on the same block as Obama's Miesian HQ? Its counterpart in Gaza is actually on a prime location to pick up the thundering shockwave of Israeli jets crossing the sound barrier. The plaza would thus come under similar sonic attack, turning it into a battlescape. Moreover, as there is no way of knowing when it gets blasted again, the plaza becomes an anxious landscape, wherein, after several exposures, federal employees acquire post-traumatic stress disorder.

Will one of the city's Olmsted parks be serenaded by the natural soundtrack of war?

Of course, most speakers will likely be on the streets and inside buildings, embedded into the sidewalk pavement and office walls, adding to the ambient noise of the city. Is that a mortar explosion or a car backfiring? Is that a malfunctioning siren humming in B-flat or the hum of the HVAC system?

Two soundscapes melting into each other.

Labels: art_installations, Chicago, sound

Tuesday, January 13, 2009

"China is a country of enormous tensions and cleavages beneath the surface.... The question is whether policy actions to date will do enough to stem a socially and politically dangerous slowdown in the economy. Whichever way the Chinese leadership responds, future generations may remember 2009 less for its global economic and financial crisis than for the momentous transformation it will have caused in China."

Dan Drezner also raises a number of excellent points concerning China, as well as several other "known unknowns" from the current financial mess. He thinks we can expect countries like China to begin de-coupling by using their fiscal stimulus plans to target domestic firms and encourage the growth of domestic markets to offset declining demand abroad. That's a roundabout way of suggesting that protectionism in on the rise and the gains in political cooperation that come from economic interdependence are on the decline. I would argue that this situation, along with the macroeconomic imbalances problem, calls for more international cooperation, not less, but is Drezner's prediction more likely?

- Russia and the Ukraine have signed a deal to resume gas flows under the supervision of international authorities. Is Russia's plummeting ruble going to make the country more or less aggressive over its energy supply policies. Or maybe: is Russia's weakening economic situation going to embolden countries like the Ukraine to provoke them even further?

Labels: China, financial crisis, Geopolitics, natural gas, Russia, Ukraine

Monday, January 12, 2009

The 2008 Limited Edition Boxster and Boxster S are priced at $49,000 USD and $59,900 USD respectively. Only 500 of the Limited Edition Boxster and Boxster S models will be made available throughout US and Canada on September 28, 2007.Sophisticated airbag safety comes standard on both Boxster models. Two full-size Advanced Airbags in front offer optimum upper-body protection, even with the top down. A weight sensor in the passenger seat automatically switches this airbag off when the seat is unoccupied or fitted with a child seat.

Add to that standard 18-inch black alloy wheels (19-inch for the Boxster S) and additional black trim pieces on the exterior, and you’ve got a fairly stunning exterior package that overshadows a garden variety Porsche Boxster with ease.

The idea of locating a compact, freerevving engine midship gave the Porsche a nimbleness no sports car had ever possessed. The Boxster shares this boldly intelligent approach to sports car design.Active electronic driver aids profoundly enhance the everyday driving stability of a Porsche. Porsche Active Suspension Management (PASM) switches to Sport mode, altering its baseline damping force for considerably firmer shock response, enabling faster turn-in as well as better road-holding and traction.

The Limited Edition Boxster and Boxster are to be clad in a stunning orange paint which was previously featured in the track-ready Porsche 911 GT3 TS. The Limited Edition Boxster is an impressive piece of work that includes a special “Limited Edition” plaque on the glove compartment. And that’s not all! Even the gray shift pattern on the gear shift lever was also tinted with orange.

Labels: Porsche

After a few years of experiencing press events hosted by European, Asian, and American manufacturers, it's become clear to me that the Germans have a flair for the flamboyant. At the rather dower 2009 Detroit Auto Show, BMW's showmanship was a welcomed relief.

The world-wide reveal of the 2009 BMW Z4 began with an acrobat doing Olympic stunts on a white curtain that looked to have been stolen from a lobby of some trendy South Beach hotel. Your humble author never quite figured out what the antics had to do with the Z4, but the new hardtop roadster is striking. The previous Z4 lost all the beauty possessed by the Z3. Some of it seems to have returned. An interesting detail is that the top lowers in only 20 seconds.

Preceding the BMW Z4 was the introduction of the Active Hybrid 7-Series. This "concept" car is a mild hybrid utilizing a 20-horsepower electric motor that is integrated into the transmission (likely an eight-speed unit built by ZF). Lithium ion batteries store power provided by regenerative braking. We're not sure why BMW showed this as a concept, because the company promised the release of an Active Hybrid (BMW's name for a mild hybrid) sometime in 2009.

Labels: bmw

Mercedes-Benz SLR McLaren Roadster even more exclusive and individual? Brabus proves that the topless Mercedes supercar can be made even sportier and more exciting with its sophisticated customization program.

To give the two-seater even more striking looks while at the same time minimizing lift on the front axle, the Brabus designers have developed a front spoiler that attaches to the production bumper. The spoiler is made from exposed carbon fiber and its shape was fine-tuned in the wind tunnel. It is especially lightweight and extremely tough. A corresponding Brabus rear diffuser made from exposed carbon fiber can replace its production counterpart.

The sporty Brabus outfit for the SLR Roadster is dominated by Brabus Monoblock VI 20-inch wheels that fill the wheel houses perfectly. The fully polished multi-piece wheels feature six double spokes and are mounted on the sports car in size 9.5Jx20 in front and size 11.5Jx20 on the rear axle. High-performance tires in sizes 255/30 ZR 20 and 305/25 ZR 20 are supplied by Brabus technology partners Pirelli and Yokohama. This low-profile tire/wheel combination is custom-tailored for the SLR coupe and roadster and benefits not only the car’s appearance but also its handling.

Thus equipped the topless SLR is ready for some additional power provided by Brabus engine tuning. The power tuning for the supercharged 5.5-liter engine consists of special camshafts, a fuel cooling system and a high-performance exhaust. With Brabus tuning, power output of the V8 compressor engine increases by 23 hp to 641 hp at 6500 rpm.

Brabus also offers a special clutch-type limited-slip differential with a locking rate of 40 percent. It further optimizes traction and improves acceleration performance of the super sports car. The tuned roadster sprints to 60 mph in just 3.5 seconds and reaches a top speed of 209 mph.

Precision handwork down to the last detail characterizes the exclusive Brabus interior design for the two-seater. The company-own upholstery shop specializes in fulfilling just about any request from discriminating SLR owners when it comes to customizing the interior. That includes a multitude of leather types and colors as well as custom upholstery designs.An unusual Brabus specialty is the waffle-patterned leather carpeting in the SLR’s footwells. Some 7,800 meters (25,600 feet) of the finest thread are sewn with utmost precision for it alone.

A sporty and functional Brabus option is the ergonomically shaped sport steering wheel that is flattened on the bottom for markedly easier entering and exiting of the vehicle. The steering wheel features integrated buttons for manual shifting of the SLR’s automatic transmission.

Sporty Brabus carbon-fiber applications for dashboard, center console and door trim transfer the racing look of the Brabus body components into the interior. The exposed carbon-fiber trim can be color-coordinated with the leather color of the interior.

Labels: MercedesBenz

Texas is facing a great pickup battle having Ford, Chevy, Dodge, and Toyota as contenders. Toyota Motor Corp., meanwhile, works to lure true truckers in Texas to win over more customers. This is why it has unleashed its redesigned Tundra to steal a portion of Ford F-150’s sales. But the best-selling pickup is not the only potent rival. There is the new Chevy Silverado and Dodge Ram. Moreover, the Japanese automaker is expected to exert extra effort in order for its goal to materialize.

According to J.D. Power and Associates, Ford F-Series dived nearly 3.6 percentage points across the nation to hold 30.7 percent of the market. In Texas, the models lost 5.5 points to fall to 31.9 percent, reported the Michigan-based R.L. Polk & Co. In comparison, the Tundra, sources divulged recorded nearly 3.5 points nationwide and 3.7 in Texas in its first year since a major redesign.

“Those numbers might not seem huge, but when you consider truck buyers are second only to luxury buyers in terms of loyalty, Ford’s drop and Toyota’s climb are significant,” said Lonnie Miller, the director of industry analysis at Polk. “There’s no doubt been a very aggressive push by Toyota.”

“We certainly had a lot more full-size pickups traded in for Tundras in ‘07,” said Tom Shopoff, the director of truck support for Gulf States Toyota, a network of dealerships that includes statewide Tundra best-seller Fred Haas Toyota World in Spring. “We have a tremendous product.”

But Shopoff predicted the Tundra would see a bubble burst. “You’ve seen the big bubble,” he noted.

Increased competition from Toyota comes at a time when auto sales in general and pickup sales in particular, are down, according to Houston Chronicle. Auto sales in 2007 fell 2.4 percent, and large pickups were down 2.7 percent, Libby said in an interview.

“That means more competition, which in turn means more incentives and lower prices,” Libby concluded. “The winner in all this is the consumer.”

Labels: toyota