|

|

|

|---|

Thursday, January 29, 2009

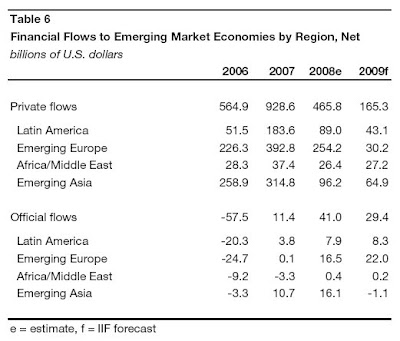

Today's statistical indicator has been brought to you by the Institute of International Finance, an association of financial institutions. 82% is the projected decline in private capital flows to emerging market (EM) economies in 2009, compared to 2007 (full report here). They now estimate flows of $165 billion, compared to $466 billion last year and $929 billion during the boom year of 2007. That's quite a drop.

Particularly hard hit will be Eastern Europe and Russia - countries that rely heavily upon external financing. Also interesting is their set of explanations for how emerging market financial institutions were hit so heavily last fall despite the fact that they weren't badly exposed to mature-market lenders. It shows very clea rly how financial problems in one part of the world can filter throughout global credit markets quite easily.

rly how financial problems in one part of the world can filter throughout global credit markets quite easily.

Furthermore, there is a danger that emerging markets in need of financing will be "crowded out" by the now massive borrowing needs of the G7 countries. Despite the huge amounts of debt they are taking on, the returns on bonds of G7 countries are still fairly low, indicating that investors still consider them safer than the alternatives. One of those alternatives is, of course, emerging markets.

The good news, according to this report, is that financial surpluses from earlier growth is giving EM economies more space for counter-cyclical monetary and fiscal policies. Moreover, while the commodity boom-now-bust has hurt some (oil-producing) EM economies hard, it's making the recovery of other (oil-consuming) EM economies easier.

But overall, the report suggests that things are looking pretty fragile, particularly for governments with little or no access to international debt markets (Argentina, Venezuela, Ecuador, Hungary, and others). This means that there will be greater need for official lending from the IMF (which has already stepped up to the plate with a whole range of new programs) as well as financing from regional development banks and bilateral agreements.

So just as private lenders in G7 economies have seized up, leaving the responsibility for economic recovery upon the shoulders of governments, so it will have to be with EM economies. Let's just hope that our official lenders are up to the task. If not, they should be given the tools they require.

(Table taken from p.7 of quoted report)

Labels: emerging markets, IMF